Shorten the Personal Finance Learning Curve

Give students hands-on experience with budgets, credit, and investments without impacting their financial futures!

Together, these products give you powerful yet easy to use resources to teach financial literacy principles, such as setting personal financial goals, understanding wages and employment benefits, improving a credit score, budgeting, and so much more.

Go Beyond Concepts to Real-life Application with the

Personal Finance Simulation

The Personal Finance Simulation uses decision-theory learning to teach students the basic principles of financial literacy in a simple and powerful way.

Rather than simply studying financial concepts, students actually experience financial decision making. They are able to make decisions on how to spend their money in an ongoing role-playing simulation that has real in-class consequences.

The Personal Finance simulation comes with a curriculum designed to help you teach personal finances in a more meaningful way. The in-class activities can easily be integrated into any existing curriculum and are designed with a teacher’s already tight schedule in mind. The curriculum and the simulation work together to reinforce previously taught subjects and lay the groundwork for content covered later in the course.

Personal Finance lesson plans are designed to follow a modified version of the 5-E Model of lesson planning: Engage, Explore, Explain, Elaborate, and Evaluate.

How the Personal Finance simulation works:

Banking

Students start with budgets to track and basic bills to pay. Academic performance in class determines if they earn raises to their salaries or lose income.

Assets & Liabilities

Students develop credit scores based on in-class behavior and simulation decisions. The scores allow them to take on liabilities and purchase assets like cars and housing.

Income Growth

Students may choose to explore other sources of income such as starting a business in class, taking a second job, or investing in the stock market.

Life Happens

Just like the real world is full of the unknown, students experience unexpected events that influence their finances within the class.

Buying Grades

By applying budgeting skills, students regularly purchase their Mimic Personal Finance score that can then be factored in as part of their total grade in class.

Teach Students

To master their money

With the Personal Finance Essentials courseware, students learn to set financial goals, follow monthly budgets, improve their credit scores, determine saving strategies, and understand the stock market. This courseware makes it easy to set students on the pathway to long-term financial success.

Expand your

Definition of Courseware

Updated every year

with lifetime access for students

100+ resources

Case studies, lecture slides, exams, lesson plans, and more

Stukent Support Team

with a 96% customer service satisfaction rating

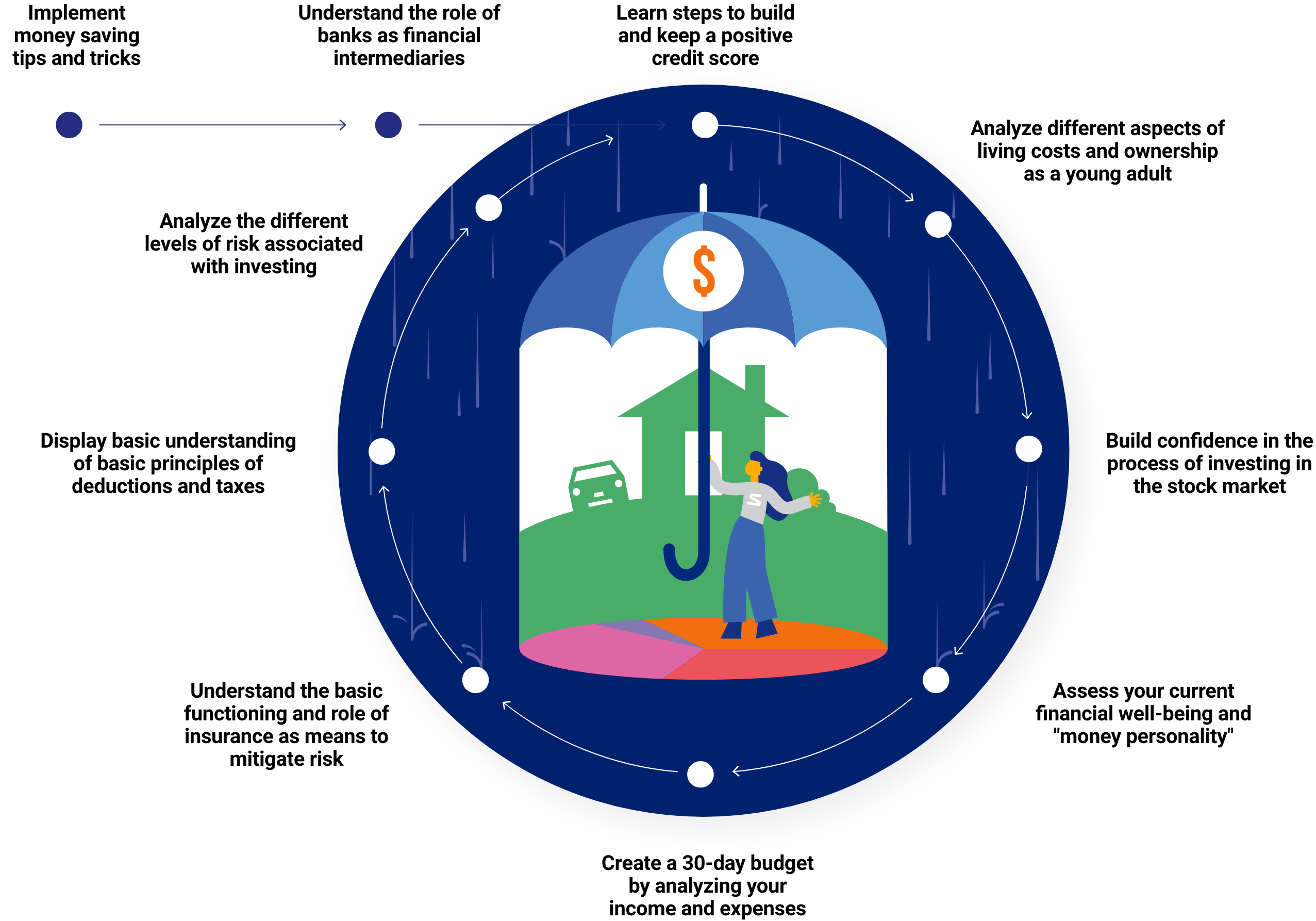

Key Learning Objectives

- Implement money saving tips and tricks

- Understand the role of banks as financial intermediaries

- Learn steps to build and keep a positive credit score

- Analyze different aspects of living costs and ownership as a young adult

- Build confidence in the process of investing in the stock market

- Assess your current financial well-being and "money personality"

- Create a 30-day budget by analyzing your income and expenses

- Understand the basic functioning and role of insurance as means to mitigate risk

- Display basic understanding of basic principles of deductions and taxes

- Analyze the different levels of risk associated with investing

Table of Contents

Chapter 1 – Introduction to Personal Finance

Chapter 2 – Personal Goals and Financial Philosophy

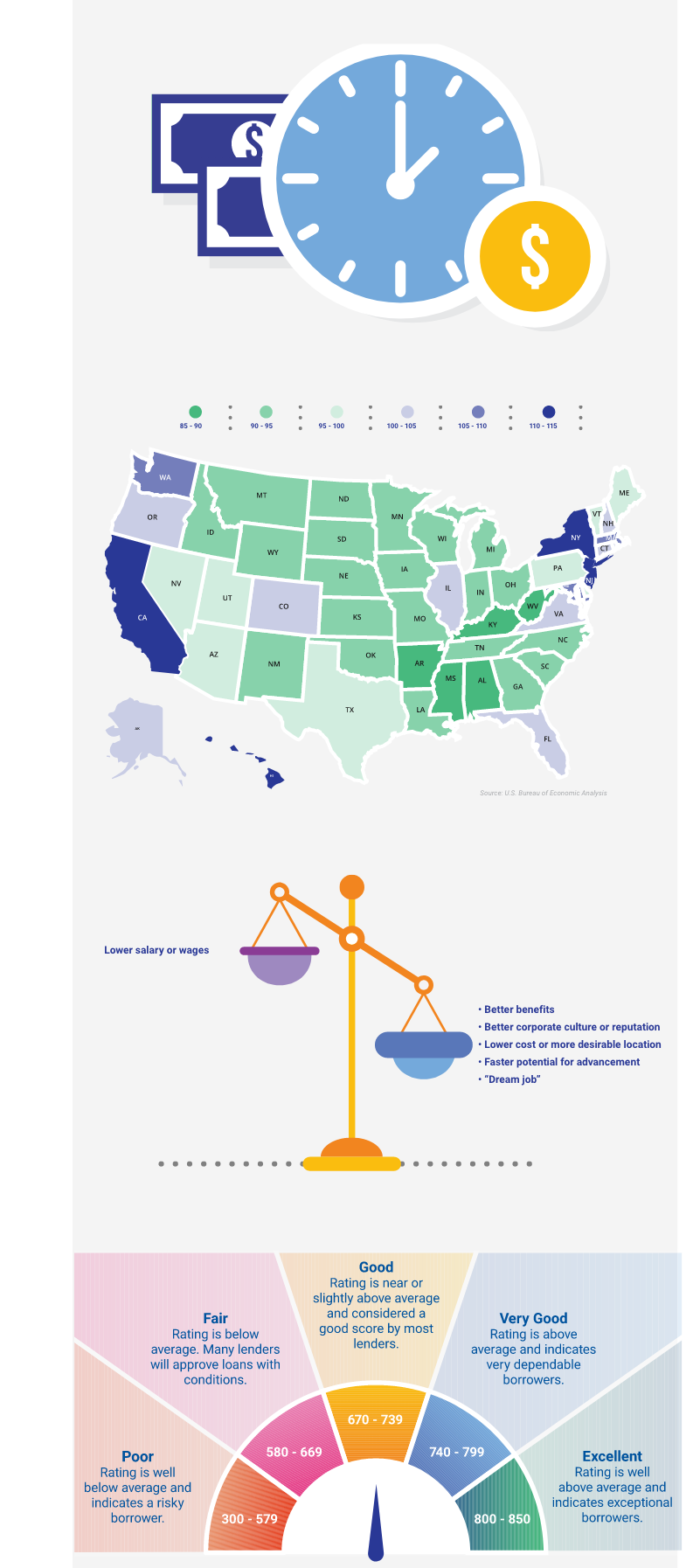

Chapter 3 – Earning Money

Chapter 4 – Budgeting

Chapter 5 – Banking and Insurance

Chapter 6 – Borrowing Money

Chapter 7 – Credit and Debit Cards

Chapter 8 – Credit Scores and Credit Issues

Chapter 9 – Spending Money

Chapter 10 – Spending on a Place to Live

Chapter 11 – Saving Money

Chapter 12 – Investing Money

Chapter 13 – Bonus: Annotated Bank Terms and Conditions

Chapter 14 – Bonus: Annotated Credit card Terms and Conditions

Chapter 15 – Bonus: Annotated Lease Agreement

More Than

120+ Instructor Resources

Include 1 Sample Syllabus with

2 Sample Course Calendars + 2 ongoing projects (30-day budget project + book report)

Related Courses

Hands-on Learning without the Hassle

Stukent Simternships integrate with your favorite LMS platforms

Single Sign-on

Grade Book Syncing

Deep Linking

Rostering

ABOUT THE AUTHOR

Ralf Mehnert-Meland

Ralf Mehnert-Meland holds a Juris Doctor from George Washington University, a Bachelor of Arts in Marketing and International Business from Carthage College, and a degree as banker (“Bankkaufmann”) in his native Germany. He has published three books on the Ecu, the predecessor to the Euro, and the European Central Bank.

Ralf has significant business experience in developing domestic and international business in the ERP, Cloud, agriculture, and healthcare industries. He is a licensed attorney and has worked in global executive and management positions in the United States and Germany.

Ralf is currently an Assistant Professor at Minnesota State University Moorhead where he teaches business law, ethics, and personal finance. His teaching philosophy is “Keep it simple, keep it real, and make it relevant for the students.”

He learned about personal finance from his teaching, jobs, and real-life experiences, but most importantly from making mistakes – and learning from them.

Mimic Personal Finance uses decision-theory learning to teach students the basic principles of financial literacy in a simple and powerful way.

Rather than simply studying financial concepts, students actually experience financial decision making. They are able to make decisions on how to spend their money in an ongoing role-playing simulation that has real in-class consequences.

The model creates an environment where students’ choices dictate the learning experience. Lessons are continually reinforced as each decision students make impacts the remainder of the course.

By letting choices dictate learning outcomes, a differentiated experience is created naturally, students master content, and learn more about themselves and their personal approach to financial matters. Mimic Personal Finance helps students learn to analyze their situation, needs, and goals while dealing with real consequences for their choices. As a result, students learn how to make smart financial decisions throughout their lives.

Table of Contents

- Chapter 1 – Introduction to Person Finance

- Chapter 2 – Personal Goals and Financial Philosophy

- Chapter 3 – Earning Money

- Chapter 4 – Budgeting

- Chapter 5 – Banking and Insurance

- Chapter 6 – Borrowing Money

- Chapter 7 – Credit and Debit Cards

- Chapter 8 – Credit Scores and Credit Issues

- Chapter 9 – Spending Money

- Chapter 10 – Spending on a Place to Live

- Chapter 11 – Saving Money

- Chapter 12 – Investing Money

- Chapter 13 – Bonus: Annotated Bank Terms and Conditions

- Chapter 14 – Bonus: Annotated Credit card Terms and Conditions

- Chapter 15 – Bonus: Annotated Lease Agreement

Key Learning Objectives

- Implement money saving tips and tricks.

- Understand the role of banks as financial intermediaries.

- Learn steps to build and keep a positive credit score.

- Analyze different aspects of living costs and ownership as a young adult.

- Build confidence in the process of investing in the stock market

- Assess your current financial well-being and “money personality”.

- Create a 30-day budget by analyzing your income and expenses.

- Understand the basic functioning and role of insurance as means to mitigate risk.

- Display basic understanding of basic principles of deductions and taxes.

- Analyze the different levels of risk associated with investing.

![]()

Banking

Students start with budgets to track and basic bills to pay. Academic performance in class determines if they earn raises to their salaries or lose income.

Assets & Liabilities

Students develop credit scores based on in-class behavior and simulation decisions. The scores allow them to take on liabilities and purchase assets like cars and housing.

Income Growth

Students may choose to explore other sources of income such as starting a business in class, taking a second job, or investing in the stock market.

Life Happens

Just like the real world is full of the unknown, students experience unexpected events that influence their finances within the class.

Buying Grades

By applying budgeting skills, students regularly purchase their Mimic Personal Finance score that can then be factored in as part of their total grade in class.