Simternship + Courseware

Two powerful assets for your accounting course

The Introduction to Financial Accounting Bundle pairs an immersive, hands-on Simternship with time-saving, resource-rich courseware. This bundle includes an interactive, multi-round simulation, an authoritative text, engaging multimedia, and a suite of auto-graded assignments and assessments.

With annually updated materials created by educators and industry experts, the Introduction to Financial Accounting Bundle contains everything you need to help your students succeed.

Skills-based. Learner-centric. Future-focused.

The Stukent Introduction to Financial Accounting Simternship

The career prep students crave

The Introduction to Financial Accounting Simternship gives students hands-on educational experiences with essential accounting practices.

Click to see what's inside

Experience the power of a Simternship with these step-by-step guides.

Key simulation learning objectives

In this simulation, your students will …

- Learn the steps of the accounting cycle in a realistic small business setting

- Understand how all steps in the accounting cycle work together

- Analyze transactions and determine how those transactions impact the accounting equation

- Record the impact of transactions using journal entries

- Understand the basic elements of the balance sheet and income statement

- Prepare and analyze financial statements in advance of approaching a bank for further financing

- Simternship Scenarios

- Round Descriptions

The Financial Accounting Simternship places students in two scenarios to create a cohesive, powerful learning experience. The first scenario helps students grasp the accounting cycle. The second scenario helps students grasp the importance of financial statements.

In each scenario, students perform job-related tasks in a real-world setting. The settings and storylines help reinforce the learning objectives and help students build marketable accounting skills.

Scenario 1: The Accounting Cycle

The first scenario places your students in the setting described below.

You are trying to save money to pay for college! Rather than spend time selling pest control or security systems or used cars, you decide to take a more adventurous route. You travel to Hawaii to start a business!

You want time on the beach, a relaxing atmosphere, and to make some money to help pay for your education. And hey, if things go well with the business, you might stick with the business and grow it into a profitable, long-term, lifestyle business.

The business involves selling sunglasses and suntan lotion and renting paddle boards and body boards on Kaanapali Beach in Maui. If things go well with your first location, you should be able to expand your locations — we will see.

During this scenario, your students will have a business partner and mentor who advises them, makes decisions, and allows the student to make a limited number of business decisions as well. The emphasis and grading of the simulation are based on how students account for those decisions via journal entries, prepare financial reports, and ultimately make a presentation to the bank for additional funding.

Scenario 2: Financial Statements

The second scenario places your students in the setting described below.

You’re a staff accountant at Carly’s. Carly’s is a retail home goods store with five locations. Carly’s has recently expanded from the original store to five stores in the past 36 months and have allocated staff time to better benchmark themselves going forward.

You will report to the CFO of Carly’s, Leo Marshall, and be tasked with working on four benchmarks for the business to better understand and assess current business performance.

During this scenario, your students will be presented with problems and asked to properly triage issues culminating with a final report to an investment banker.

Scenario 1: The Accounting Cycle

Round 0 – Scenario Setup

Scenario: The student is introduced to the business opportunity, business partnership, and the overall setting of the simulation.

Round 1 – Pre-Revenue Part 1

Scenario: The student is asked to make limited business decisions while others are made for them. The student is introduced to journal entries with a focus on properly accounting for the given transactions. (Pre-revenue)

Round 2 – Pre-Revenue Part 2

Scenario: The student is asked to make limited business decisions while others are made for them. The student is introduced to journal entries with a focus on properly accounting for the given transactions. (Pre-revenue)

Round 3 – Weeks 1-2

Scenario: Business is open and the student must properly account for business activities. As the simulation progresses, the transactions will be more complex.

Round 4 – Weeks 3-4

Scenario: The student continues to account for business activity with an emphasis on properly identifying the accounting entry that will ultimately lead to accurate business financial statements.

Round 5 – End-of-Month Adjustment (Month 1)

Scenario: The student must make month-end entries to ensure financial statements are accurate.

Round 6 – Month 2

Scenario: The student continues to account for business activity with an emphasis on properly identifying the accounting entry that will ultimately lead to accurate business financial statements.

Round 7 – End-of-Month Adjustment (Month 2)

Scenario: The student must make month-end entries to ensure financial statements are accurate.

Round 8 – Month 3

Scenario: The student continues to account for business activity with an emphasis on properly identifying the accounting entry that will ultimately lead to accurate business financial statements.

Round 9 – End-of-Month Adjustment (Month 3)

Scenario: The student must make month-end entries to ensure financial statements are accurate.

Round 10 – Prepare Income Statement and Trial Balance

Scenario: In preparation for scaling the business (bank ask), the student is asked to prepare the needed financial reports.

Round 11 – Evaluate Financial Reports

Scenario: The student evaluates the financial reports in order to measure financial stability and prepare for the bank ask for extended credit.

Round 12 – Pitch to the Bank

Scenario 2: Financial Statements

Round 0 – Scenario Setup

Scenario: The student is introduced to the position and the company they work for.

Round 1 – Prior Year Comparisons (Two Years Ago)

Scenario: The student is asked to compare Carly’s financial statements across the years. The student will calculate a number of financial ratios using the reports provided.

Round 2 – Prior Year Comparisons (Last Year)

Scenario: The student is asked to compare Carly’s financial statements across years. The student will calculate a number of financial ratios using the reports provided.

Round 3 – Benchmark against Industry Data

Scenario: The student is asked to compare Carly’s most current year-end financial statements to industry data provided by the CFO who received it from the investment banker. The student will compare the ratios in order to identify potential areas for improvement.

Round 4 – Target/Plan Comparisons

Scenario: The student is asked to compare Carly’s current year financial statements to the target/plan for the year. The student will calculate a number of financial ratios using the reports provided.

Round 5 – Benchmark against Walmart and Target

Scenario: The student is asked to compare Carly’s most current year-end financial statements to titans within the same industry, Walmart and Target. The student will calculate a number of financial ratios using the reports provided.

Round 6 – Triage Issues

Scenario: The student will finalize the areas of improvement based on the comparable data from all four comparables.

Round 7 – Final Report to Investment Banker

Scenario: Time advances by nine months to see how the identification of problem areas has bettered Carly’s financial ratios. The student finalizes a report to the investment banker.

Round 8 – Simternship Closure

Reflection

Stukent Simternships

Employ Students

in Career-Relevant Learning

A Stukent Simternship® is a career-relevant, work-integrated learning experience that helps your students connect classroom concepts to real-world tasks.

In a Simternship, students become marketing managers, PR officers, entrepreneurs, SEO specialists, accountants, and more. They will interact with simulated supervisors and coworkers, perform realistic tasks, and build their confidence within the safety of a simulated environment.

Hands-on Learning without the Hassle

Stukent Simternships integrate with your favorite LMS platforms

Single Sign-on

Grade Book Syncing

Deep Linking

Rostering

Practice, Meet Pedagogy

Pair your Simternship with Stukent courseware

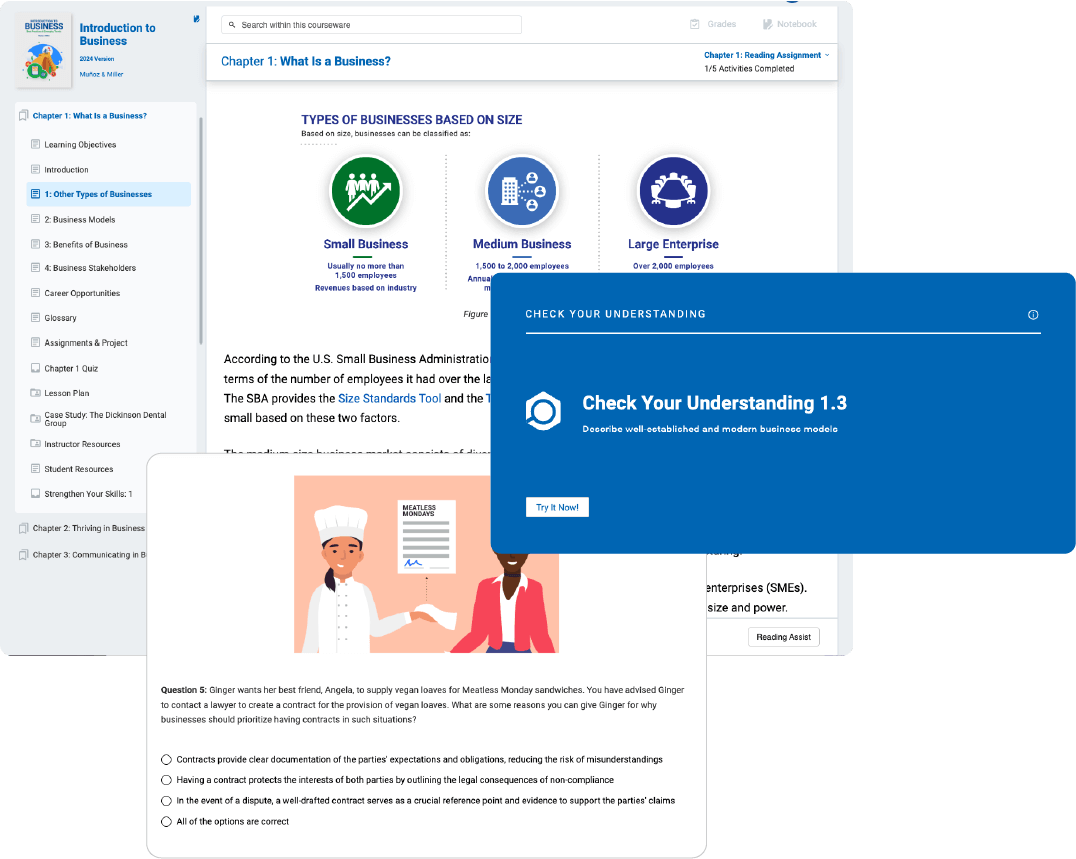

Stukent courseware aligns with your Simternship, giving your students a solid foundation for success.

Stukent Courseware

Courseware that thinks

outside the textbook

Introduction to Financial Accounting Courseware

Stukent courseware goes beyond the limitations of the printed textbook, pairing powerful instructional resources for you with an annually updated, concise text for students.

An Authoritative Text + Robust Instructional Resources

Introduction to Financial Accounting

Get an accounting curriculum that’s backed by more than 70 years of experience with Stice and Stice’s “Introduction to Financial Accounting” courseware! This courseware acquaints students with the mechanics of accounting, including internal controls, receivables, inventory and cost of sales, investments, liabilities, equity, cash flow, and financial statements.

“Introduction to Financial Accounting” includes over 22 hours of author-led video content to scaffold students’ understanding of core course concepts. Best of all, the courseware is easy to implement in any course or class modality, allowing you to focus on what matters most: your students.

What’s Inside?

Table of Contents

- Chapter 1: Purpose and Users of Accounting

- Chapter 2: Overview of the Financial Statements

- Chapter 3: The Accounting Cycle: The Mechanics of Accounting

- Chapter 4: Completing the Accounting Cycle

- Chapter 5: Internal Controls: Ensuring the Integrity of Financial Information

- Chapter 6: Receivables: Selling a Product or Service

- Chapter 7: Inventory and the Cost of Sales

- Chapter 8: Employee Compensation

- Chapter 9: Investments: Property, Plant, and Equipment and Intangible Assets

- Chapter 10: Financing: Long-Term Liabilities

- Chapter 11: Financing: Equity

- Chapter 12: Investments: Debt and Equity Securities

- Chapter 13: Statement of Cash Flows

- Chapter 14: Analyzing Financial Statements

- Appendix: The Time Value of Money

Key courseware learning objectives

In this courseware, your students will …

- Construct and interpret both a balance sheet and an income statement

- Construct and interpret a statement of cash flows

- Understand the process of accounting and the links among the three primary financial statements

- Use the debit-and-credit system to analyze, record, and summarize transactions

- Use standard financial statement analysis tools and interpret the outputs from those tools

- Understand the importance of internal controls and audits to the reliability of the financial reporting process

200+ Embedded Educator Resources

Everything you need to teach your

your best course

- Auto-graded assessments & activities

- 75 lecture slide decks

- 20+ lesson plans

- Engaging, author-led video content

- Sample syllabus and course calendar

- Cumulative glossary

- LMS integration with Stukent platforms

About the Authors

Jim Stice

Emeritus Professor of Accounting at Brigham Young University

Jim Stice is an emeritus professor of accounting at Brigham Young University, where he spent his career teaching, conducting research, and serving in administrative roles. He’s won numerous teaching awards, served as a visiting professor at INSEAD, and worked in executive education for companies such as IBM and Ernst & Young. Over his 30-year career, Jim has educated thousands of accounting students and professionals in person and has reached millions of learners online.

Kay Stice

Emeritus Professor of Accounting at Brigham Young University

Kay Stice is an emeritus professor of accounting at Brigham Young University. He holds a bachelor’s and master’s degree from Brigham Young University and a Ph.D. from Cornell University. He’s taught at top universities around the world and won numerous awards, including the Maeser Excellence in Teaching Award at BYU, which is the university’s highest teaching honor. In his 30 years of teaching, Kay has taught thousands of students in person and millions online.

Trusted by Teachers, Endorsed by Employers

Why educators love Stukent

Don’t just take it from us — here’s what high school and

higher education instructors say about our simulations and courseware.

One Platform. Hundreds of Resources. Unlimited Possibilities.

Additional resources for creating a great course

Always have the

latest edition

This courseware contains robust instructional resources for educators and students. Best of all, the Stukent team updates the courseware annually, which means your curriculum will always be on the cutting edge of your industry.

Support for you,

support for students

The Stukent Support Team helps students and educators get the most out of their Stukent experience. Whether you need help logging into your Stukent Simternship, navigating your courseware, or understanding simulation results, we’re here to help!

Stukent Events

Join us for webinars, product launches, and more!

Trusted by the World’s Most Innovative Institutions