The Managerial Accounting Simternship® + Courseware

Show students the business impact of managerial accounting

The Managerial Accounting Bundle pairs an immersive, hands-on Simternship with time-saving, resource-rich courseware. This bundle gives you comprehensive resources to create an engaging learning environment and get students excited to learn.

Take learning beyond the book

Stukent Managerial Accounting Simternship

Launch careers with a Simternship

The Managerial Accounting Simternship goes beyond your average business simulation, allowing your students to put the concepts you’re teaching them to work.

Your students will ...

Identify product costing adjustments

Perform cost variance analysis

Create budgets

Perform Key Performance Indicator (KPI) analysis

Determine break-even points

Review purchasing strategy

Bridge the theory-practice gap

with a Simternship

The Managerial Accounting Bundle includes the Managerial Accounting Simternship, an immersive, career-relevant simulation that allows your students to practice essential accounting skills. The Simternship asks your students to interact with simulated supervisors and coworkers, perform realistic tasks, and build confidence in the safety of a simulated environment.

Key simulation learning objectives

In this simulation, your students will ...

- Identify product costing adjustments and recommend changes

- Determine break-even points for the company’s two locations

- Create a cash budget for both locations

- Review cost variance analysis to locate costing issues

- Review purchasing strategy to determine make or buy options

- Conduct Key Performance Indicator (KPI) analysis to identify areas for improvement

Hands-on Learning without the Hassle

Stukent Simternships integrate with your favorite LMS platforms

Single Sign-on

Grade Book Syncing

Deep Linking

Rostering

Practice, Meet Pedagogy

Pair your Simternship with Stukent courseware

Stukent courseware aligns with your Simternship, giving your students a solid foundation for success.

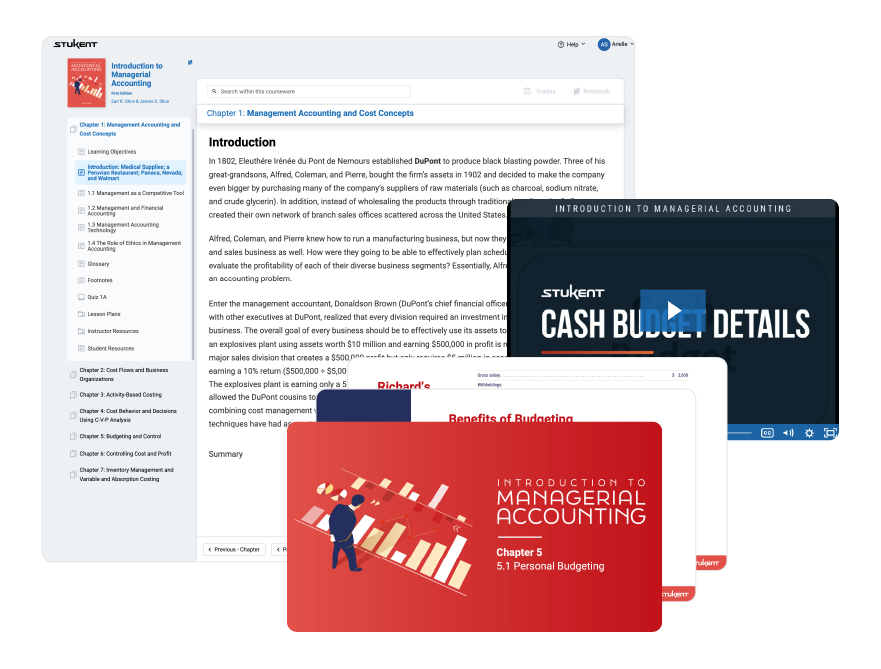

The “Introduction to Managerial Accounting” Courseware

A cutting-edge curriculum backed by decades of experience

The “Introduction to Managerial Accounting” courseware gives you everything you need to teach a great course. This courseware contains ready-made resources, including:

- Engaging explanatory videos from the authors

- Auto-graded quizzes and assignments

- Turnkey lesson plans

- Lecture slide decks

- A sample course calendar

- And more!

Together, authors Dr. Earl K. Stice and Dr. James D. Stice have more than 70 years of experience teaching accounting. They bring a practical, hands-on approach to modern accounting subjects, providing you with the resources to teach an authoritative course in less prep time.

Courseware that thinks

outside the textbook

Stukent courseware goes beyond the limitations of the printed textbook, pairing powerful instructional resources for you with an annually updated, concise text for students.

The “Introduction to Managerial Accounting” courseware isn’t a textbook; it’s a turnkey accounting curriculum with a full suite of educational tools. You’ll get instructional videos from the authors, auto-graded assignments and assessments, lecture slide decks, lesson plans, and so much more.

Managerial Accounting Table of Contents

Medical Supplies; a Peruvian Restaurant; Panaca, Nevada; and Walmart

I Paid the Restaurant $18, But How Much Did My Meal Cost Them to Make?

Which Airline Passengers Create the Overhead? Why Do I Have to Pay?

Ramona’s Charity Banquet

The Excruciating Excitement of Living from Paycheck to Paycheck

A Case Study in Cost Variance Analysis: Living Through a House Remodel

Who Pays for Rent on the Factory Building: This Year’s Customers or Next Year’s Customers?

Is It Faster to Drive or to Fly When Traveling from Salt Lake to Denver?

To Buy Or Not To Buy: The Weekend Car in Hong Kong

Flying a Boeing 737 on Fuel Made From Garbage, Used Cooking Oil, and Barnyard Waste

Tesla’s Transformation from a Negative to a Positive Free Cash Flow Company

The French Revolution, Gunpowder, and Financial Statement Analysis

The Time Value of Chocolate

Key courseware learning objectives

In this courseware, your students will ...

- Construct and use product cost information in a classic job-order costing system

- Apply activity-based costing to allocate overhead in an economically justifiable way

- Construct and use break-even analyses including consideration of mixed costs and sales mix

- Construct and use budgets, including sales budgets, production budgets, and cash budgets

- Construct non-routine decision analyses including special orders, outsourcing, and cost-based pricing

- Construct and use performance evaluation measures for cost centers, profit centers, and investment centers

- Use the time value of money to make long-term capital budgeting decisions

- Create and interpret a statement of cash flows

- Perform a comprehensive financial statement analysis using the DuPont framework, common-size financial statements, and other financial ratios

- Use computer-aided learning tools and online learning resources

100+ Embedded Educator Resources

Everything you need to teach

your best course

- Sample syllabus

- Course calendar

- 12 chapters

- 26 lesson plans

- 69 lecture slide decks

- 12 end-of-chapter assignments

- 12 quizzes

- Hundreds of embedded videos

- 12 weeks of in-class activities

About the authors

Jim Stice

Emeritus Professor of Accounting at Brigham Young University

James D. Stice (Jim) is an emeritus professor of accounting at Brigham Young University, where he spent his career teaching, conducting research, and serving in administrative roles. He’s won numerous teaching awards, served as a visiting professor at INSEAD, and worked in executive education for companies such as IBM and Ernst & Young. Over his 30-year career, Jim has educated thousands of accounting students and professionals in person and has reached millions of learners online.

Kay Stice

Emeritus Professor of Accounting at Brigham Young University

Earl K. Stice (Kay) is an emeritus professor of accounting at Brigham Young University. He holds a bachelor’s and master’s degree from Brigham Young University and a Ph.D. from Cornell University. He’s taught at top universities around the world and won numerous awards, including the Maeser Excellence in Teaching Award at BYU, which is the university’s highest teaching honor. In his 30 years of teaching, Kay has taught thousands of students in person and millions online.

Trusted by Teachers, Endorsed by Employers

Why educators love Stukent

Don’t just take it from us — here’s what high school and

higher education instructors say about our simulations and courseware.

Trusted by the World’s Most Innovative Institutions

One Platform. Hundreds of Resources. Unlimited Possibilities.

Additional resources for creating a great course

Annual Updates

Stukent courseware are updated annually to keep your instructional materials on the cutting edge of your industry.

Support for Students

Anyone who uses Stukent courseware automatically has access to Stukent's support team to answer any technical inquiries.

Blog

Stay current with blogs about hot topics in the industry.

Stukent Events

Join us for webinars from industry professionals, Stukent authors, professors, and more!

Experiential Learning

Learn how virtual work-integrated learning can help educators overcome today's instructional challenges.