Real-world projects can transform and elevate any accounting course. Projects allow your students to engage with the course material meaningfully and provide hands-on learning opportunities that last a lifetime. Students don’t just learn about skills, they gain them.

Brothers Dr. Kay Stice and Dr. Jim Stice are the coauthors of the Stukent “Introduction to Financial Accounting” and “Introduction to Managerial Accounting” courseware.

In a recent Stukent webinar, the professors discussed their favorite ways to engage accounting students in the classroom: “Projects have all kinds of benefits that can aid you in grabbing the interest of accounting students,” Kay said. “For many of us, we’re finding that accounting is becoming a more difficult sell because other topics attract students who should be ours. Projects are one way to help with that.”

The Stice brothers shared how you can utilize real-world projects and Simternships™ in your accounting class to make students engaged and excited learners.

According to the Stice brothers, good experiential projects include:

- An introduction to a realistic business environment relative to what students get in textbook exercises and classroom discussions.

- “Messy fact situations” relative to the sterile, clear-answer settings they get in their homework.

- Group settings in which students learn to navigate interpersonal situations, such as group dynamics, managing workloads in a team, and schedule planning.

- A confirmation that classroom content has relevance in the real world.

During the webinar, Jim and Kay shared five of their favorite projects from their own accounting classes over the years. They’ve also provided the project instructions on the webinar page, which means you can adopt their projects into your course today.

1. EDGAR Search Project

In this assignment, your students examine the most recent annual financial statements of three companies: Microsoft, Google, and Apple. Next, they navigate to the Securities and Exchange Commission’s website and search for the respective companies’ filings using the provided instructions.

Students locate the companies’ most recent 10-K filings, focusing on the financial statements within these reports.

For each company, students gather six financial statement quantities:

- Total revenue

- Total cost of revenue

- Net income

- Total assets

- Total liabilities

- And total stockholders’ equity

After obtaining the financial statement numbers, students will compute four financial ratios for each company: debt ratio, gross profit percentage, return on sales, and return on equity.

Students must submit a table containing the 30 numbers (10 for each company) and provide a brief written interpretation of each ratio, explaining its implications for the differences or similarities among Microsoft, Google, and Apple.

During the webinar, an attendee asked the Stice brothers if students could easily cheat on this project using ChatGPT. To that, Kay responded: “This type of project will grab the interest of potential accounting majors who are the best students. The student who doesn’t want to do it, or who’s going to copy off their friend — let those students do that.”

Kay said that students who are interested and put effort into their projects are likely to be more successful.

2. Computing Google’s Goodwill Project

In this project, students analyze Google’s 2022 balance sheet and gather specific financial numbers.

Students identify the following values:

- Total cash

- Cash equivalents and marketable securities

- Property and equipment, net

- Total assets

- Short-term debt

- Long-term debt

- Total liabilities

- And total stockholders’ equity

Students use the Interbrand website to determine the current estimate of the fair value of the Google brand name. Additionally, they will evaluate the current market value of Alphabet’s shares — referred to as the company’s market capitalization — using the Yahoo Finance website.

Lastly, students will estimate the current value of Alphabet/Google’s self-developed goodwill, considering that recorded amounts for assets and liabilities are approximately equal to their fair values.

The professors said this exercise engages students with a well-known company like Google and reassures them of their skills.

3. Cost of Production at Your Favorite Restaurant Project

In the next exercise, students visit their favorite restaurants to gather information and compute the production cost of their favorite meal. They write a concise description of the restaurant and the meal, followed by the computation of the production cost. The production cost includes direct materials, direct labor, and overhead costs.

While enjoying their meal, students note the food material costs, including any disposable packaging expenses. They also estimate labor costs, considering the server, cook(s), and other staff based on hourly wages and the time spent.

The challenging part involves estimating the allocation of the restaurant’s overhead costs to the meal — students estimate the monthly overhead cost and determine a suitable portion to allocate to their specific meal.

“Students love this project,” Kay said. “It’s a simple project, but they are implementing the skills they are learning in the class in a real environment.”

Jim added that having detailed instructions help the students to build confidence and skills going into each project.

4. Financial Statement Analysis Project

In this project, students form study groups and analyze financial statements for a publicly-traded company of their choice. They access the SEC archives to obtain the financial statements. The group then submits a written executive summary of their analysis and presents their findings to the class.

During the analysis, the group evaluates the company’s overall financial health by computing and interpreting ratios, including those in the DuPont framework and other applicable ratios. Students assess ratio changes over time, compare ratio values with industry peers, and consider any limitations of financial statement analysis. Additionally, the group should identify the most interesting fact in each document, including the balance sheet, income statement, statement of cash flows, and the notes to the financial statements.

Professors and students enjoy this project — it makes a great social event, and students may dress up in business or formal attire!

5. Small Business Valuation Project

Students work in groups to perform a small business valuation as if they were financial advisors recommending a purchase price to an investment fund.

Students step into the roles of managing partners of the investment fund, and they choose a small business for valuation. Notably, the valuation process must be passive, meaning they cannot directly question the business owners or employees to obtain financial data. The project includes two deliverables: a written report and a presentation.

The students generate their valuation recommendation using both price multiples (a market approach) and discounted cash flow (DCF) analysis (an income approach). They explain the assumptions made in their data generation, including the selection of comparable companies for the multiples approach and the computation of the discount rate for the DCF analysis. Reconciling the differences between the multiples-based and DCF valuations is also required. An example of a past valuation using Crumbl Cookies gives students an idea of how to approach the project.

Jim said this project gets students to observe businesses in their community and demonstrates the challenges of the valuation process.

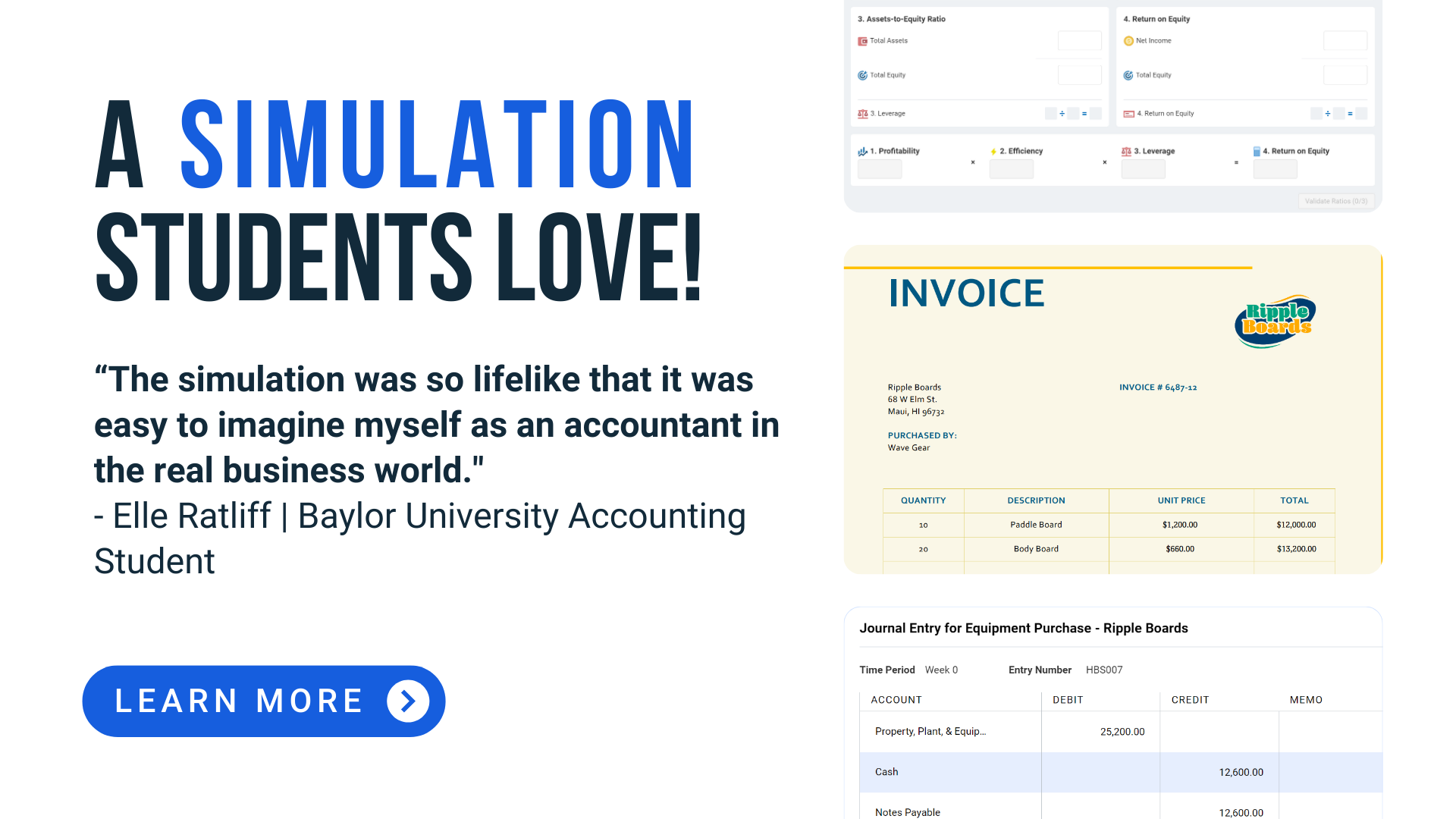

Stukent’s Financial Accounting Simternship

The Stice brothers also discussed the Stukent Financial Accounting Simternship, a state-of-the-art accounting simulation that allows students to get hands-on experience with the accounting cycle or financial statement analysis. Together with Stukent, the Stice brothers have developed an easy-to-implement, engaging experiential learning experience to use in your classroom.

“Students think, ‘I don’t have eight hours to work on a simulation, I’ve got to study for an exam.’ So, I always tell my students, ‘By doing this you’re actually studying for the exam,’” Jim said. “This Simternship is a great way to refresh how to do journal entries, how to do adjusting entries, how to do closing entries, [all of] which is going to be on the exam.”

The Financial Accounting Simternship is fully customizable for the forward-thinking accounting classroom. This semester-long simulation provides hands-on learning for either the accounting cycle or for financial statement analysis, allowing students to perform job-related tasks in a real-world setting. The immersive storylines help students not only understand the learning objectives but also to understand the rationale behind vital accounting practices, too.

You can watch Jim and Kay walk through the Financial Accounting Simternship during their webinar or schedule a walk-through with one of our course consultants today!

Stukent is here to help educators help students help the world. To learn more about our first-in-the-world Simternships and courseware, or to get FREE instructor access to our products, visit our website.