Due to advancements in technology, the field of accounting is rapidly evolving. To help you get ahead of new trends, we asked CEOs, founders, and other business leaders how the industry will evolve over the next three to five years. From accountants transitioning into product management to an increase in blockchain usage, Stukent gained valuable insights that can help you stay ahead of the curve.

Here are eight ways accounting will change in the coming years:

- Public Accountants Becoming Product Managers

- A More Remote Workforce

- An Increase in Using AI Solutions

- A Move to Green Accounting

- Outsourcing Will Become More Prevalent

- Necessary Increases in Data Security

- Heavier Reliance on Data Analysis for Trend Predictions

- The Use of Blockchain Tech

Public Accountants Becoming Product Managers

I worked as a public accountant fresh out of college. It’s hard to audit a company while getting paid a fixed salary and calculating the earnings of tech startups. Admittedly, the mind starts to wander.

Which is why I think more public accountants will make the jump to being product managers at tech startups in the next three to five years. The numbers work out, and the transition to product management isn’t as stark a difference as you’d think. They train public accountants to understand workflows, processes, and internal controls really well.

Guess what product managers do? The same stuff. They design workflows, create powerful processes for users, and proactively build internal controls to help govern a site.

That’s why I think you’ll see more accountants do what I did — quit and put their skill sets towards something with a higher ROI.

Brett Farmiloe, CEO, Terkel

A More Remote Workforce

The remote workforce is one of the biggest changes that we expect to happen in the accounting field in the next three to five years. With the technological advances we have today, there is no need for accounting firms to be tied to a physical office space.

This allows firms to hire the best talent from anywhere in the world, and it also opens up opportunities for accountants who may not relocate. We believe this trend will only continue to grow in the coming years, as more and more firms realize the benefits of a remote workforce.

Lorien Strydom, Executive Country Manager, Financer.com

An Increase in Using AI Solutions

Automation is being increasingly adopted to take care of time-consuming, routine accounting processes, and the movement will only pick up steam over the next few years. Saving countless hours and precious labor for accounting teams, these tools can quickly and accurately compile large volumes of data and reduce the potential for human error — transcribing the correct numbers is no longer an issue.

Automation won’t remove the need for a human presence, but transform it. For example, accountants will need to audit in-house data for accuracy and spend more time analyzing and using data to make intelligent financial forecasts and strategies.

Ruben Gamez, Founder & CEO, SignWell

A Move to Green Accounting

Paper has long been the most used material in accounting, but not for long. Paper accounting is on its deathbed because of technological advancements.

Paper accounting has been responsible for businesses having entire storage rooms for paper records and files, leading to a lot of time and resources being used to retrieve and maintain them.

Going green also eliminates the use of printers and saves on inks and stamps. Transforming the paper-heavy accounting industry into a paperless one is a sustainable move for both the environment and the accounting businesses.

Yongming Song, CEO, Live Poll for Slides

Outsourcing Will Become More Prevalent

One new strategy developing in the accounting industry is outsourcing. It enables businesses to put more emphasis on their core tasks as opposed to worrying about trivial matters. They benefit from greater concentration on values like profitability and resources when laborious work is outsourced to professionals or businesses.

As a result, the accounting industry’s fastest-growing sector is now outsourcing services. Because of the more skilled and dependable professional services they receive, businesses increasingly choose to outsource their accounting needs. It is a powerful way for CPAs to impress clients with their work and boost their credibility.

Brian Clark, Founder, United Medical Education

Necessary Increases in Data Security

The traditional workforce is changing, therefore the accounting workforce is changing. I believe one thing we can expect is an increase in using data security.

The world is becoming increasingly technological. So much so that there are only a few businesses left that don’t use technology to operate; even those are becoming slim. As we share more data between accounting firms and clients, there are more opportunities for hackers and data stealers to commandeer private data.

Accounting firms must protect themselves from cyber threats and data security issues. With cloud-based technology taking center stage in the accounting field, companies are shifting from susceptible data-sharing processes to secure data-sharing processes.

I believe that as the industry adopts a technology-based mindset, we will see an increase in accounting firms implementing two-factor authentication and encrypted security to decrease the risk of looming cyber threats.

Henry Abenaim, CEO, Fundingo

A Heavier Reliance on Data Analysis for Trend Predictions

Forecasts help businesses prepare so they can decide more wisely when it is time to make important business decisions. Soon, the heavy demand for data experts in the accounting sector will soar.

Data analytics make it easier to spot operational inefficiencies and effectively control hazards. Companies are realizing the power of data analysis for forecasting. To support decision-making based on data, more companies will put more money into data analysis. We can expect accounting firms to examine past performance data for their clients to predict the future.

Sally Johnson, Founder & CEO, Green Light Booking

The Use of Blockchain Tech

Experts and innovators are eyeing the use of blockchain technology in the accounting industry. Blockchain technology poses interesting use cases for accounting, primarily for its possibility to offer a more modern type of accounting ledger that can be verified and continuously updated with strong security.

Blockchain tech is notorious for its unflinching security and independence from banks, two aspects that will make a revolutionary impact on the accounting industry.

Blockchain tech is slowly but surely gaining ground in accounting because it can make it easier for accountants to access ledgers in real-time, document transactions, and create contracts.

Jonathan Merry, Cofounder & CEO, CryptoMonday

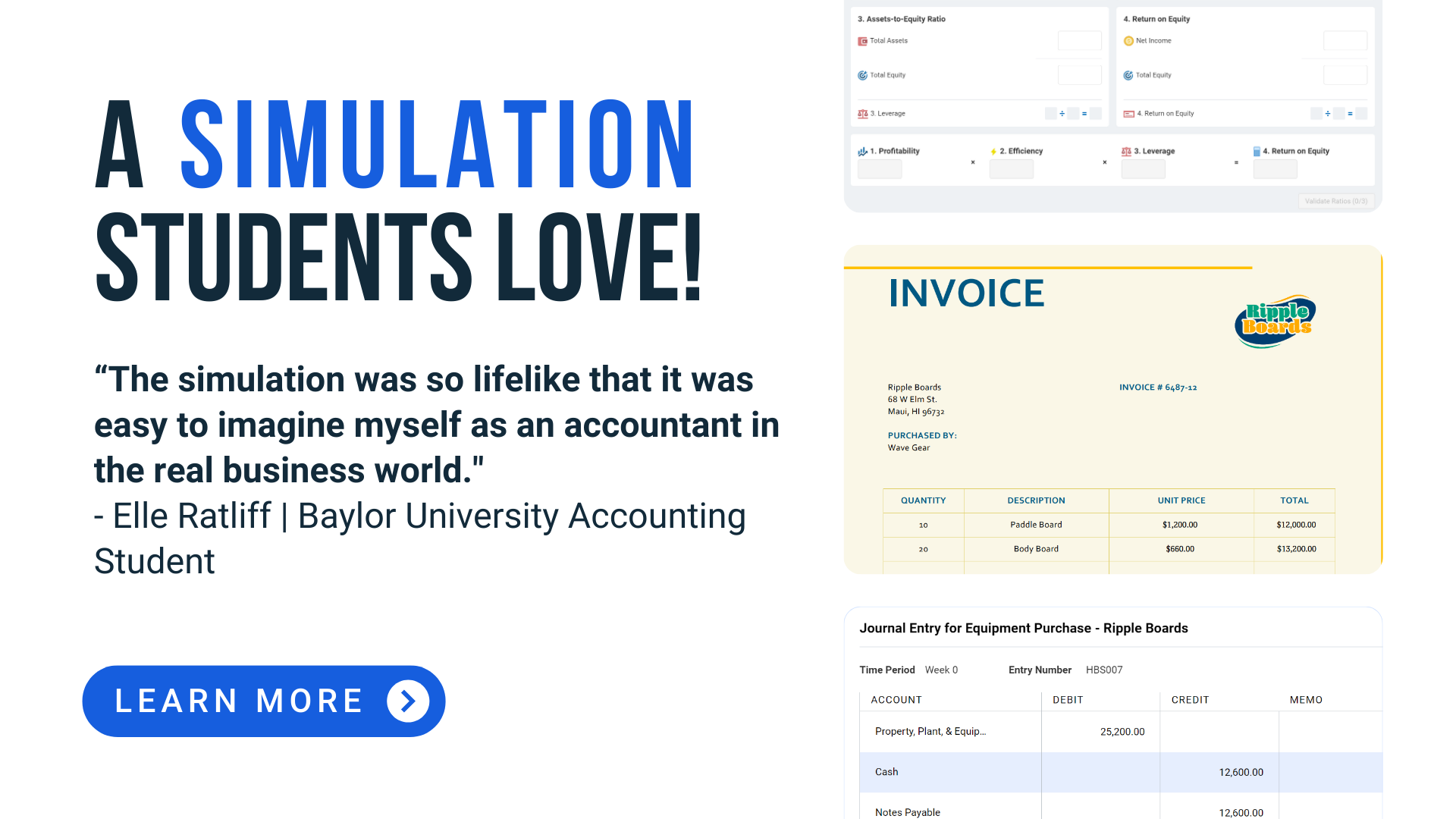

Staying up to date with the accounting industry can be a daunting task, but Stukent can help! Whether you’re looking to stay current with accounting trends or to give your students real-world experiences, Stukent’s immersive simulations and engaging courseware can help you prepare yourself or others for success.

To learn more about Stukent’s accounting products, visit our website.