Until recently, accounting circles talked about artificial intelligence (AI) as a future disruptor. Today, that disruption has arrived — and most accounting professionals are responding with optimism. According to “The State of AI in Accounting Report 2025” by Karbon, 85% of accounting professionals say they are “excited” or “intrigued” by AI, while those feeling “skeptical or scared” have dropped by 7% from 2024 (p. 6).

Even more telling: 80% of professionals have seen increased AI functionality in the software they already use, and 63% are now using AI for communication tasks such as writing emails (Karbon, p. 10). AI is shifting from novelty to necessity, becoming a daily tool in firms of all sizes.

For accounting educators, that’s a clear signal. AI is becoming central to the profession, and classrooms need to evolve accordingly.

This blog explores how today’s accounting professionals are embracing AI and why those changes should be reflected in college accounting instruction. You don’t need to be an AI expert to prepare students for an AI-enhanced workplace. You just need to show them what’s happening — and help them think critically about how they’ll use AI.

The AI Shift in Accounting: From Disruption to Daily Use

Often feared as a threat, AI has embedded itself into accounting workflows as a supportive tool, not a liability. AI is now being deployed in taxes, auditing, advisory, and even fraud detection. That shift makes the human accountant more critical than ever in decision-making.

Karbon’s research confirms that 41% of professionals are automating tasks, and 39% are using AI for research and insights (p. 10). But adoption is no longer just about saving time. Accounting experts are using AI as a strategic tool that offers a competitive edge.

AI Is Now Part of the National Infrastructure, Including Tax Enforcement

AI’s evolution isn’t confined to private firms. Public agencies are catching up. The IRS is now using AI to identify audit risks and allocate resources more effectively — an indication that new hires will be stepping into AI-powered environments from day one (Accounting Today, 2024).

Leadership Drives the Shift, but Not Everyone’s Caught Up

In Karbon’s survey, 63% of firm leaders expressed excitement about AI’s role, compared to just 40% of individual contributors who expressed excitement (p. 6). That gap points to a training opportunity educators can fill.

At the same time, many professionals remain cautious. Some worry AI could reduce the need for junior staff in entry-level bookkeeping or tax preparation roles (Accounting Today, 2024). To counteract this concern, students should leave the classroom equipped with AI skills.

Tools like ChatGPT Are Already Integrated into Workflows

Mainstream generative AI tools like ChatGPT are becoming part of daily operations. Accountants are using them to draft emails, generate memos, summarize client documents, and role-play client conversations (Karbon, 2024).

Why This Shift Should Reshape the Accounting Classroom

Employers expect new graduates to be comfortable working in AI-enhanced environments. In fact, 79% of accounting professionals believe that graduates are more likely to join firms that use advanced technologies (Karbon, p. 13).

While fears about job loss have decreased, the nature of the work is shifting. AI is handling low-level, repetitive tasks like categorizing transactions and drafting standard reports. This creates more space for entry-level staff to engage in judgment-based work — if they’re prepared.

Classroom Silence on AI Sends the Wrong Message

When instructors avoid AI, students are left to interpret its role on their own, often with confusion or worry. But when educators lead the discussion, students learn to see AI as a tool to augment their skills, not replace them.

You Don’t Have to Be a Tech Expert to Start

Instructors can explore AI through classroom debates, ethical case studies, or reflection assignments. Students can analyze how AI might affect internal controls, research how regulators are using it, or simulate tasks using free tools like ChatGPT.

Practical Ways to Introduce AI Topics into Your Curriculum

Start with what’s already happening in the field:

- Analyze Karbon’s AI use statistics or recent headlines about the IRS.

- Review AI-generated financial forecasts and compare them with manual outputs.

- Simulate a firm’s AI strategy using real-world software tools.

Make it hands-on and career-relevant:

- Assign projects that use AI to summarize client data or create mock presentations.

- Host ethical discussions about AI’s limitations and potential biases.

- Ask students to research how firms are using generative AI to improve efficiency and communication.

These activities don’t require AI mastery — just curiosity, critical thinking, and context.

How Stukent Supports AI Accounting Education

You don’t need to be an AI expert to prepare students for an AI-enhanced profession — you just need the right tools.

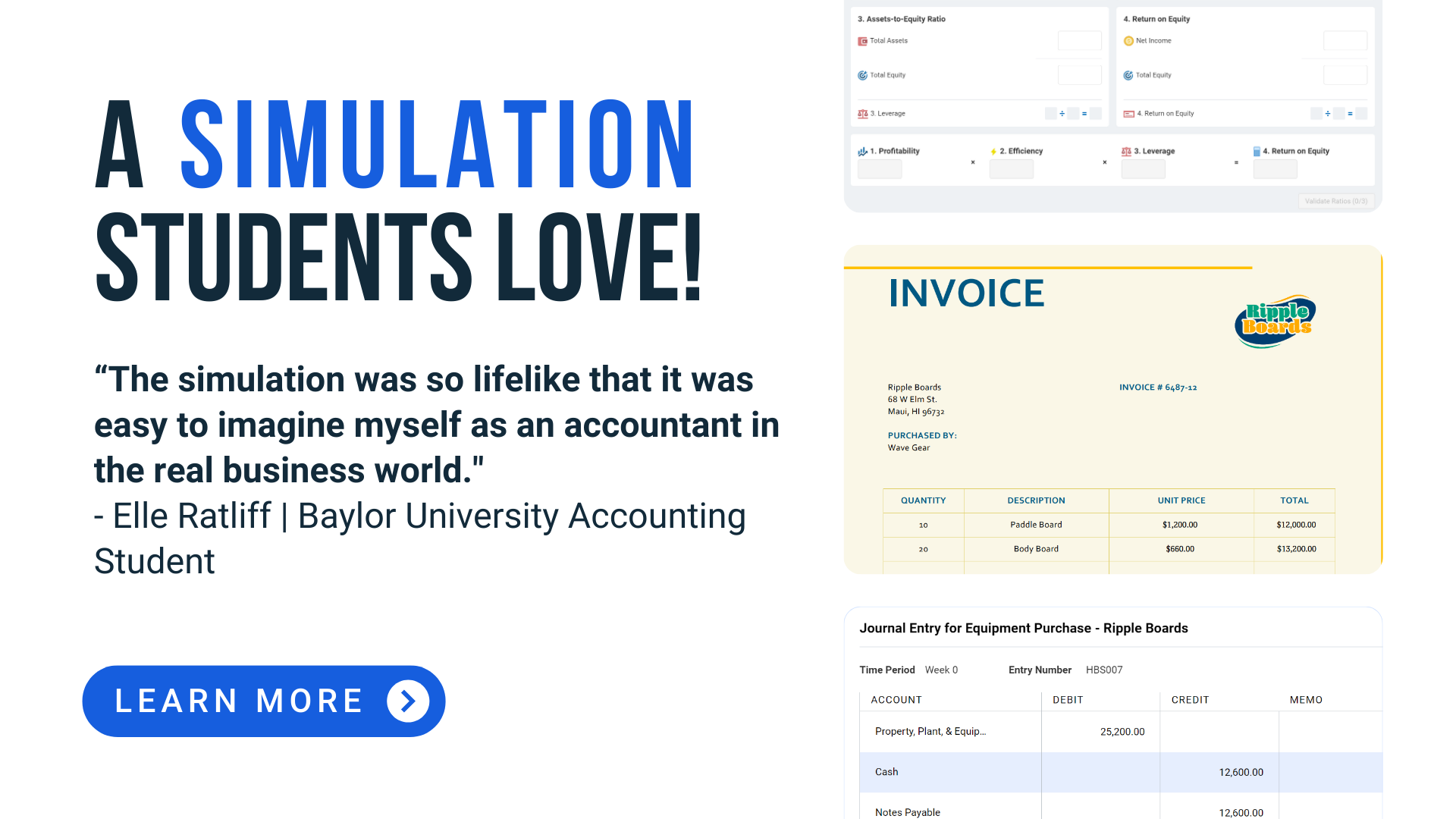

Stukent accounting courseware and simulations provide a modern, flexible foundation for bringing emerging topics like AI into the classroom. Whether you’re teaching financial, managerial, or survey-level accounting, each resource is built to save prep time and support real-world readiness.

- The Financial Accounting Bundle features a Simternship and courseware updated annually.

- The Managerial Accounting Bundle features a Simternship and courseware updated annually.

- The “Survey of Accounting” courseware supports foundational concepts through multimedia, market data, and complete instructional resources.

These tools make it easy to introduce technology conversations, ethics, and modern workflows into existing structures, helping students connect theory to the realities they’ll face in the workplace. Want to learn more? Get started with free instructor access!