Each of the articles in the “5 Top Secrets” series lifts the hood on one of our first-in-the-world educational resources to help you gain superior insight on the topic covered. Stukent courseware gives you a fast-track to engagement. And engaged students learn quicker and more. It’s all part of Stukent’s mission to help educators help students help the world.

The statistics reveal a stark reality: Fewer than one-third of young adults in the United States say their high school education prepared them to handle personal finances. Sixty-nine percent of parents are reluctant to speak with their children about finances, and only 23 percent of young people say they talk with their parents regularly about money management. Despite those findings, only 21 states required a financial literacy course for high school graduation in 2020.

To help students get off to a strong financial start, Stukent joined forces with former high school teacher Brian Bean to offer Stukent Personal Finance, a hands-on personal finance simulation.

Fueled by a financial mistake that drove him to bankruptcy after college, Bean said he “didn’t understand how someone could [earn] a bachelor’s degree in science and still be so ignorant to something that should have been practical knowledge to many people.” He went on to study banking and finance and then devoted himself to helping young people learn how to handle money.

The Stukent Personal Finance simulation is an outgrowth of his efforts — and here are five secrets about how the simulation is set to build financial literacy.

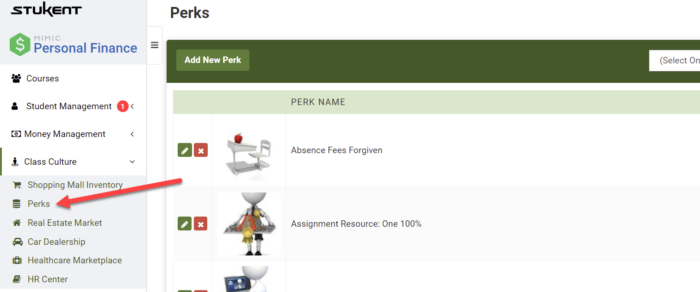

Top Secret #1: Perks Keep Students Engaged

The simulation includes perks to help promote student engagement. Participants quickly learn that money management isn’t only about the big choices: every dollar spent is one less dollar available to help pay bills and meet a budget.

Instructors have full control over which perks to offer and when to offer them. Check the MPF Simulation Instructor Guide (Dashboard > Training Resources) for direction on how to create, edit, and apply perks — but definitely use them. They can add an emotional component that intensifies choices.

Top Secret #2: You Can Add Special Privileges

Privileges have the power to make the simulation even more realistic, not just fun. You can give students power to affect the grades they earn, classroom seating, tardies, and more.

Remember, though, nothing is free. Always attach a price to any perk or privilege your students want. You can also reverse the process: Students turn in an assignment late? Fine them. They want a hall pass? Charge them for it.

In the simulation, students have opportunities to learn how to gauge opportunity costs for financial decisions. Tying results to actions helps make the impact of financial choices something the students experience for themselves.

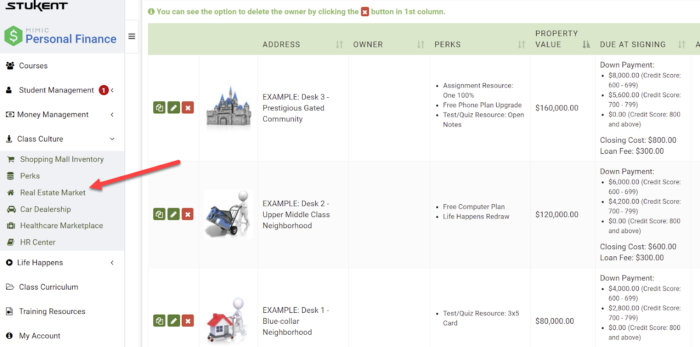

Top Secret #3: MPF Adjusts to Fit the Class

Instructors can adjust the simulation to provide a richer and more rewarding experience for their particular situations.

Classes with fewer students might produce a buyer’s market in housing, while larger classes might find a seller has the upper hand in real estate transactions. Similarly, first period students will likely place a high value on tardy forgiveness though fourth-period students won’t be as interested. Get a pulse for your classes and their preferences and then use supply and demand principles to your advantage.

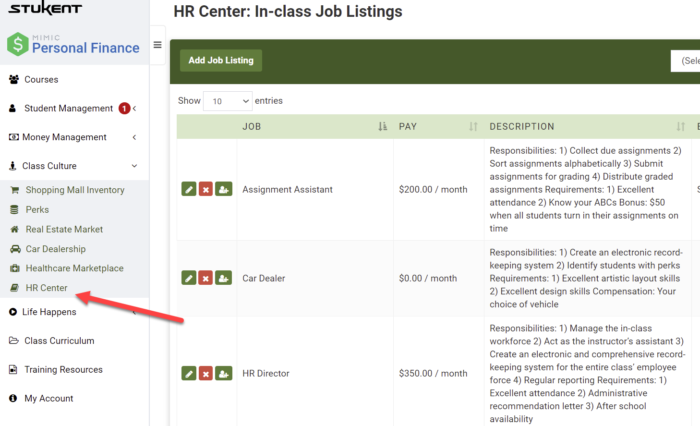

Top Secret #4: Work Provides Rewards

Adults who want a better car or nicer home may need to take a second job to pay for their desires. You can give students side jobs in class to allow them similar situations. Jobs are also a way to cultivate more buy-in from your students.

Have fun with the hiring process, and let the students take an active part in creating a unique class culture. Be sure to hire an HR staff, though. That group can manage the workforce for you!

Top Secret #5: You Can’t Break the Simulation

Don’t worry about “breaking the sim” or “not doing it right,” especially at first. MPF is a game-changer, and change can be difficult if you take on too much too fast. Start off slowly, then gradually allow your courses to become more complex within the MPF system. The payoff is amazing, but if the learning curve seems too steep, slow down.

Many teachers begin by awarding participation points the first time they use MPF simulation.

Have fun. Experiment with the options, but be ready for your students to ask for more.

If you’re already leveraging Stukent Personal Finance in your class, congratulations. Your students are fortunate. If you’ve not yet registered, though, schedule a demo online today.

Help your students help themselves, so they can go on to help the world.