You may feel like you’re the only person who is struggling to pay off student loans fast, but you’re definitely not. In fact, 44.7 million U.S. citizens have some form of student loan debt, and the U.S. total student debt has reached $1.768 trillion.

Here, you’ll find out how student loans work and how to pay off student loans fast.

It may seem like student debt is impossible to escape, but there are lots of ways to pay off student loans and live life too.

Needless to say, knowing how student loans work is one thing and knowing how to pay off student loans fast is another.

How Do Student Loans Work?

Federal Student Loans

If you’re looking for a straight-forward explanation of how student loans work you’re definitely in the right place.

Federal student loans come in four basic forms:

- Direct Subsidized Loans for students

- Direct Unsubsidized Loans for students

- Direct PLUS Loans for graduate and professional students

- Direct PLUS Loans for parents

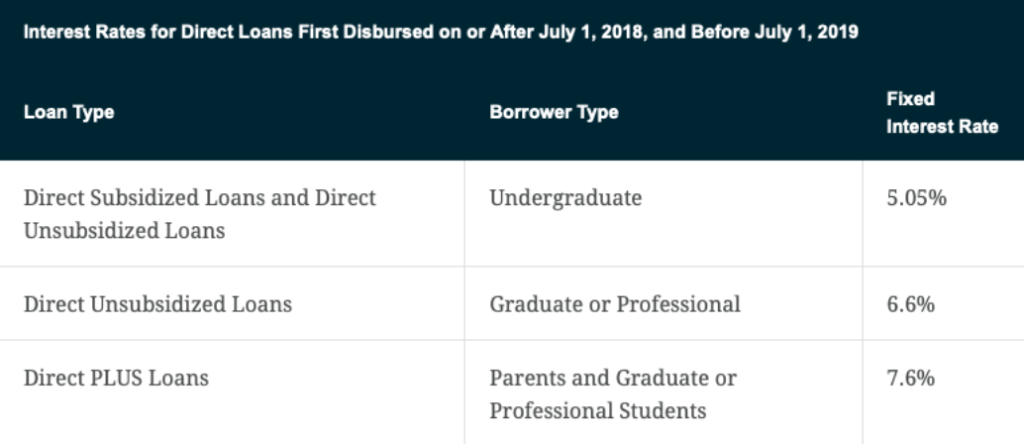

Federal student loans offer fixed interest rates and greater flexibility than private student loans.

The federal government has created different payment processes depending upon your ability to make payments and whether or not you need student loan forgiveness.

Standard Repayment

If you want to pay less interest, standard repayment is your best option. You’ll make equal monthly payments for 10 years, and if you stick to the plan, you’ll pay less overall interest and pay the loan off faster.

Income-driven Repayment

If you need to make smaller monthly payments, income-driven repayment is your best option. This means you’ll use income-based repayment (IBR), income-contingent repayment (ICR), Pay As You Earn (PAYE), or Revised Pay as You Earn (REPAYE).

With income-driven repayment, your monthly payments will be determined by your income, but your loan payment term will be 10-15 years longer than a standard term. At the end of the term, any leftover loan balance is forgiven, but you still have to pay taxes on the remaining amount.

Terms and conditions for federal student loans are controlled by the government and often include benefits that private loans don’t, such as flexible payment options and fixed interest rates.

Private Student Loans

So, how do student loans work in terms of private lenders?

Unlike federal student loans, private loans don’t usually come with different repayment options. So it is smart to apply for and use the maximum amount of any federal loan you receive before searching for a private loan.

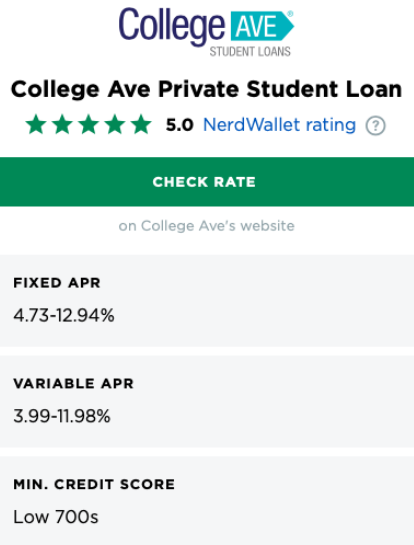

Once you have exhausted all of your federal loan funds, it is important for you to check with various lenders to locate the lowest interest rate. Interest rates change depending upon your credit or your co-signer’s credit.

When it comes to any student loan, but especially private loans, only borrow what you need.

Private loans do not always have fixed interest rates like federal loans. Generally, you can choose between a fixed or variable annual percentage rate (APR). Fixed interest rates are usually higher than variable rates because lenders want to ensure they will make money on your loan. Variable rates change over time, and fixed rates do not.

According to e-Student Loan, “When you choose a variable rate, you are betting that interest rates won’t rise substantially during the repayment term. If you choose a fixed rate, you are betting that rates will increase.”

Now that you’ve got an answer to, “How do student loans work?” you’ll need to know how to apply for student loans.

How to Apply for Student Loans:

Federal Student Loans

To apply for a federal student loan, you must submit a free application for federal student aid (FAFSA).

Federal Student Aid provides a helpful video to help you understand how to apply for student loans:

Private Student Loans

Knowing how to apply for student loans can be difficult, especially when it comes to private lender processes.

According to LendingTree, Private loan application processes vary by lender, but it can be beneficial to have certain pieces of information ready once you begin any private lender application process.

Helpful documents and information can include:

- Social Security number

- Telephone number, date of birth, address

- Gross annual income

- List of assets and asset values

- Monthly rent or mortgage

- Latest tax return

- Employment information

- Most recent pay stub

- A secure personal reference

How to Pay Off Student Loans Fast

The faster you can pay off student loans, the better. The longer it takes to pay off student loans, the more money you’ll have to pay in interest.

It can be difficult to live life with student debt hanging overhead. Money that could be going to a mortgage, vacation, college fund for your children, or new car gets caught up in monthly student loan payments.

You’ll learn how to pay off student loans fast with these 15 tips and tricks.

1. Make larger payments

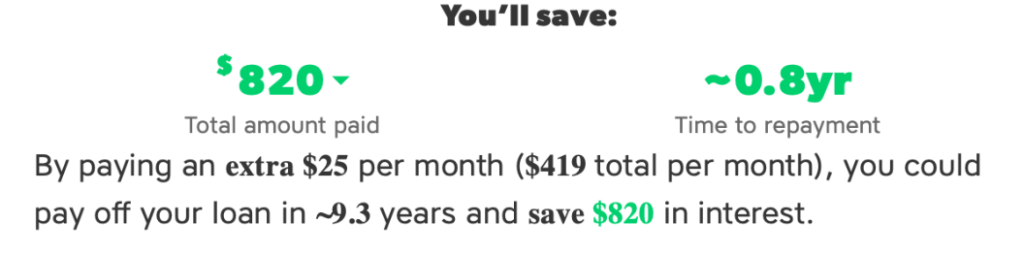

You can pay off student loans fast by simply making larger payments. If you have the means to make bigger payments, then you’ll also end up paying less interest.

According to Bank Rate, the average student loan debt is around $37,172, with an average interest rate of just over five percent. If you were to make minimum payments for 10 years, you would end up paying $10,140 extra in interest.

Making minimum payments on student loans is a quick fix, but making larger payments will be beneficial in the long run.

For example, if you had the average amount of student loan debt with a five percent interest rate, and you were to increase your payment by just $25 a month, you would pay your student loan off about eight months quicker and save around $820 in interest.

2. Put any unexpected income towards the loan

Chances are you already have a budget in place and a repayment plan set up, so it can be easy to look at unexpected income as “fun money.” But, if you have the means to survive on your regular income, putting an entire raise towards your loan can cut it down by multiple payments.

This goes for any source of unexpected income that isn’t necessary to support your lifestyle.

According to the National Association of Colleges and Employees (NACE), the average starting salary was $50,156 in 2017. So, let’s say you have $37,172 in student debt with a five percent interest rate, and you’ve been working a job with a salary of $50,156 for the last few months since graduating.

You’ve decided to make monthly payments of $432 a month because you want to pay off your loans a bit quicker. But your boss just mentioned you’d been performing really well, and she is going to give you a $600 bonus in December.

If you put the $600 towards your student debt, you’ll knock out more than one month’s payment!

3. Cut back on unnecessary expenses

Budgets make it easier for you to plan ahead and to recognize what you should and shouldn’t be spending money on.

Federal Student Aid provides a helpful video for making a solid budget:

Create a list of all of your expenses, and then order them by importance. In terms of paying student loans off fast, the stricter you are with budgeting, the better. Some people suggest going on a “shopping ban” by only buying the absolute essentials.

It may not seem like much in the moment, but costs add up quickly.

Take for instance, the “Latte Factor.” It essentially claims that people could make hundreds of thousands of dollars over time if they were to cut out unnecessary expenses like daily coffee runs, a third car, or even cable tv and invest the money instead.

4. Carefully choose your repayment plan

In terms of federal student loans, standard repayment terms are 10 years long, but if you opt for an income-driven repayment plan, your repayment term can last up to 20 years. If you are unable to make standard payments on your loan, it is better to use an income-driven plan than to miss payments altogether.

As for private loans, there aren’t quite as many repayment options. You can refinance your loans for lower interest rates and change up the length of your repayment term.

You can also consolidate all of your loans into one private loan for a single interest rate. Doing so will remove perks that come with federal loans.

Or, you can consolidate your federal loans into one federal loan, so you only have to make one federal payment a month. but this can jeopardize income-driven repayment plans and flexibility that comes with certain types of federal loans.

5. Take advantage of a student loan monthly payment calculator

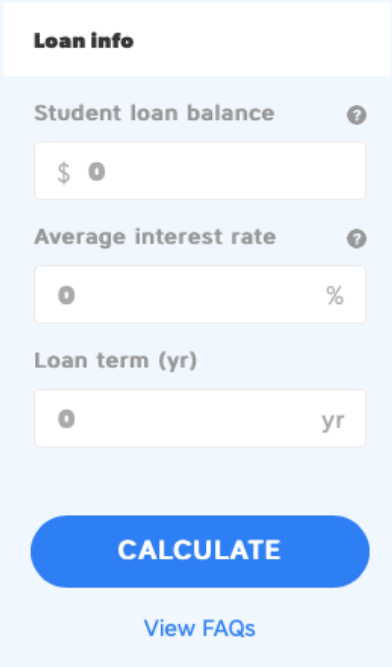

Payment Calendar

A student loan monthly payment calculator will help you determine the amount you have to pay each month based upon your loan balance, interest rate, and loan term.

Try out a student loan monthly payment calculator:

6. Find a job that offers loan forgiveness

If you have received federal student loans for an education in which you will work in a public service organization or high-need area, you can take part in work programs to receive loan forgiveness.

You can also receive loan forgiveness from a university, a private organization, the federal government, or a state government if you work in specific areas such as:

- Federal agency employee

- Public service worker

- Doctor/physician

- Lawyer

- Nurse

- Teacher

- Automotive professional

- AmeriCorps, Peace Corps, etc.

- Dentist

- Pharmacist

- Veterinarian

The LendingTree provides a complete list of student loan forgiveness programs.

7. Use grants to pay off student loans

Much like loan forgiveness, you can use grants to pay off student loans.

Some of these grants include:

- Contraception and Infertility Research Loan Repayment Program

- Iraq and Afghanistan Service Grant

- John R. Justice Student Loan Repayment Program

- National Institute of Mental Health Loan Repayment Program

- New York State Young Farmers Loan Forgiveness Incentive Program

- North Dakota Science, Technology, Engineering, and Mathematics Student Loan Grant

- Nurse Corps Repayment Program

- Pennsylvania Primary Care Loan Repayment Program

- The Veterinary Medicine Loan Repayment Program

- Department of Justice Attorney Student Loan Repayment Program

- Herbert S. Garten Loan Repayment Assistance Program

Here, you’ll find 120 more options to use grants to pay off student loans.

Keep in mind that every organization has a specific set of requirements you must meet when you use grants to pay off student loans.

8. Start a side-gig

Any extra income you can put into paying off your student loans fast will benefit you. A side-gig can really be anything you want it to be. Do you love to write, edit, drive, teach, even design?

If so, you can become a freelance writer or editor, an Uber or Lyft driver, an ESL instructor, or a freelance designer. There are plenty of options for making money on the side!

9. Build investments

A unique way to pay off student loans fast is to make minimum monthly payments on your loans and invest any extra money you have. With this approach, you will put the least amount of money possible into your loan while you build up your savings, retirement, or investments. Then, when you reach the end of your payment term, you can use the money you’ve invested to pay the remaining taxes on your student loans and hopefully have money left over.

There are many ways to invest and save money—here are some suggestions:

- AMERITRADE or E*TRADE

- Traditional or Roth IRA

- 401k

- Savings

- Stocks

- Bonds

- Mutual funds, exchange-traded funds, or index funds

- Real estate

10. Set up automatic payments

You authorize your lender to remove student loan payments directly from your bank account each month when you choose to use autopay.

There are three benefits to using automatic payments:

- You don’t have to remember to make payments every month.

- Your interest rates may decrease depending upon your lender.

- You can set up larger monthly payments.

If you are able to keep your bank account full enough for automatic payments, then this could be the perfect option for you to pay off student loans fast.

11. Use student loan interest for tax deductions

The interest you pay on student loans during a tax year can be deductible.

According to TurboTax, “Your deduction is limited to interest up to $2,500, or the amount of interest you actually paid, whichever amount is less. As with most tax credits and deductions, there are limits in place.”

You’ll have to fill out a 1098-E form and may have to contact your lender for more information.

12. Make bi-weekly payments

Split up your payments into a half-payment every two weeks. You can even make half-payments every time you get a paycheck. There will be two months in which you will make an extra half payment.

Depending upon the details of your loan, you could save hundreds, maybe even thousands in interest from those two extra half-payments a year.

The CalcXML calculator can help you estimate savings if you were to make bi-weekly payments. For example, if you have $37,172 in student debt with a five percent interest rate, and you make bi-weekly payments of $197, you’ll save $1,098 in interest and pay off your loans in about nine years instead of 10.

13. Try the avalanche method

You can use the avalanche method to pay off student loans fast. Essentially, you attack your largest loans one by one until each is paid off.

This means you make minimum payments on all but your largest loan. Once the largest is paid off, you move on to the next.

14. Try the snowball method

The snowball method is the opposite of the avalanche method. To pay off student loans fast, you attack your smallest loans first and make minimum payments on all of your other loans.

Once the smallest loan is paid off, you move onto the next.

15. Use cashback programs

Cashback programs like Ibotta, Ebates, and BeFrugal allow you to scan your receipts and use coupon codes from various locations to earn cash. While the cash you earn from scanning receipts and using coupon codes may seem minimal, it will benefit you in the long run.

You’ll save money on groceries, furniture, even beauty supplies and can use the cash to pay off student loans fast.

The amount of money you’ll save depends on the stores you shop at, the deals that are available, and how often you use the apps.

For example Ibotta shares reviews from some of its customers:

Frequently Asked Questions:

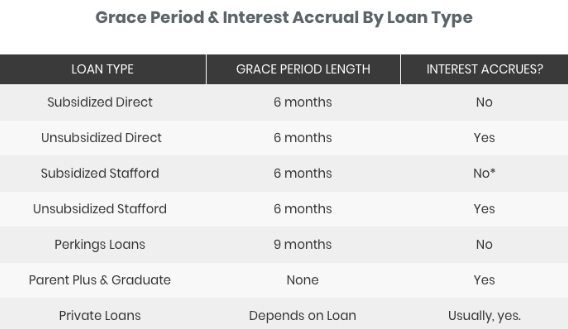

What is a grace period?

It can be hard to pinpoint what a grace period is exactly because it can be different for every type of loan.

According to Student Debt Relief, “ A grace period is one term that’s provided for student loans that allows you to delay payments up to a certain length of time, without penalty.”

Both federal and private loans can have grace periods, but not all of them do. Likewise, some loans continue to build interest during the grace period, and others don’t.

What happens to student loans when you die?

You’re certainly not the only person who’s wondering what happens to student loans when you die.

When it comes to federal loans, if you die, your loan will be discharged after proof of death is submitted. If your parents have a PLUS loan and you or the parent who obtained the loan die, the loan will be discharged after proof of death is submitted for you or the parent. However, if both parents obtained the loan, the surviving parent must still pay off the loan.

As for private loans, the process for your student loans when you die is a bit complicated because it depends upon the regulations of your lender, but there are general rules that can apply to most circumstances.

What happens to student loans when you die can differ depending upon whether or not you have a cosigner. For many organizations, if you die and have a cosigner, the cosigner must repay the loan. It is rare to find a private lender that discharges loan repayment for a cosigner upon the death of the borrower. If you do not have a cosigner, most private lenders will discharge remaining loan balances upon your death.

Again, these rules can differ depending upon your student loan contract.

Should I refinance my student loans?

When you refinance a loan, you are essentially using a new loan with new conditions to pay off an old loan.

You have to consider several components of private and federal loans when you ask, “Should I refinance my student loans?”

Federal loans can be refinanced, but you will not be able to take part in federal income-driven repayment plans or loan forgiveness programs.

The interest rates, term lengths, and repayment options of federal student loans are quite unique, so pay extra attention to each of the changes that will occur if you decide to refinance.

If you have both federal and private loans, you can consolidate them into one private loan and then refinance, but consolidating and refinancing federal loans with private loans takes extra consideration. You can no longer take part in federal loan forgiveness programs, income-driven repayment plans, deferment, or forbearance.

Private loans can be refinanced if you are looking to change the payment term or interest rate of your loan. People often refinance when an old loan becomes too high-risk to manage.

In short, be very cautious when you refinance your student loans no matter what type they are.

What is a Pay As You Earn student loan?

According to the Consumer Financial Protection Bureau, “Pay As You Earn, or PAYE…caps your monthly federal student loan payment at 10 percent of your discretionary income.”

A Pay As You Earn student loan is a form of federal income-driven repayment. In order to qualify for it, your first federal student loan has to have been borrowed after October 1, 2007, and you must have borrowed a Direct Loan or a Direct Consolidation Loan after October 1, 2011.

You also have to demonstrate financial need.

The U.S. Department of Education has a Pay As You Earn student loan calculator to determine if you qualify for PAYE. You must have a federal student loan login to access it.

Stay Dedicated

It takes dedication to pay off student loans fast.

Student loans can be complex and complicated, but don’t let that stop you from managing them altogether.

If you can commit to at least one of these 15 ways to pay off student loans fast, you can kickstart your loan repayment process and begin your journey to becoming debt-free.