Prepare Students for

Bright Financial Futures

Build financial literacy in your community while building your brand! By sponsoring the Stukent Personal Finance Curriculum, our white-label simulation, you can put powerful, engaging financial literacy tools into local students’ hands.

High school is a critical time

to teach students about personal finance

Personal Finance Simulation

The Stukent Personal Finance Simulation adds real-world opportunity costs to students’ financial decisions, which means the simulation affects students’ circumstances in class.

This simulation helps students learn to set and achieve personal financial goals, create and follow a monthly budget, understand wages and employment benefits, improve a credit score, purchase assets, invest in the stock market, and so much more.

Join a Growing List of Sponsors

Thanks to our generous partners throughout the country, thousands of high school students in the United States are learning the personal finance skills they need for lifelong success.

Book a Demo

As a sponsor, you will have the unique opportunity to build relationships with local schools and students as well as foster financial literacy in your community.

Partnering with Stukent is easy as 1, 2, 3!

HOW SPONSORSHIP WORKS

Identify the Area(s) to Sponsor

No one knows your customers as well as you do! Select which school districts or regions you would like to sponsor, or areas where your contribution might have the greatest impact.

Outreach and Onboarding

Our business development team contacts eligible schools in your selected area(s) to inform them of your generous contribution. Next, we present the Stukent Personal Finance simulation to teachers and explain its benefits. You won’t receive an invoice until a school commits to using the Stukent Personal Finance simulation.

Promotion and Marketing

To highlight your contribution, our marketing team will create a complete media package tailored to your needs and brand voice. We have a wide variety of tools to highlight your organization, including television advertisements, in-person events, social media marketing campaigns, press releases, and more.

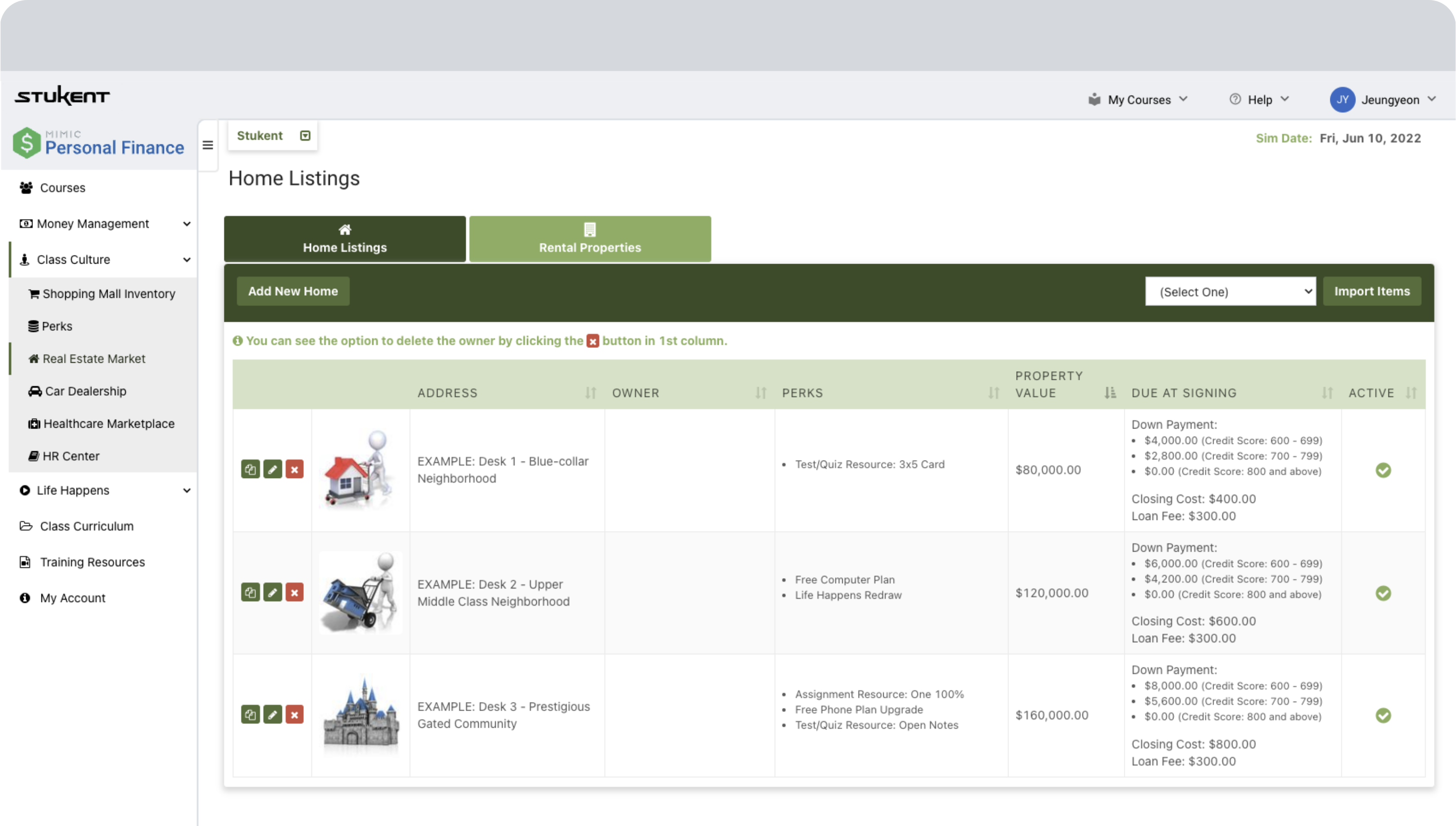

THE STUKENT PERSONAL FINANCE SIMULATION

Students receive a salary every Monday, which they allocate to living expenses, bills, and major purchases such as real estate and health care. Bills are due every Friday.

Additionally, students can use their discretionary funds to purchase in-class perks, such as desk locations, bathroom passes, and flashcards for exams.

But students need to be prudent with their money! At the end of the simulation, students need to have invested enough in their grades to earn a good score.

The Stukent Personal Finance Bundle

The Stukent Personal Finance simulation gives students relevant, hands-on experience with important financial literacy concepts. This simulation doesn’t just gamify personal finance principles, it creates real-life experiences, giving each student a differentiated learning experience.

The simulation comes with a curriculum designed to help you teach personal finances in a meaningful way. The in-class activities can easily be integrated into any existing curriculum and are designed with a teacher’s busy schedule in mind. The curriculum and the simulation work together to reinforce concepts and lay the groundwork for content covered later in the course.

Help Your Students Make Sense of Their Finances

With the Stukent Personal Finance Simulation, your students will …

Develop a personal approach to financial matters

Manage a budget, lines of credit, personal assets, and more

Experience consequences in a low-risk environment

Plan for the future and mitigate unexpected events