Students Need Your Help

Did you know 43 states don’t require a financial literacy course to graduate? The main issue is that states don’t provide funding for financial literacy curriculum, but that’s where you come in. You can help by sponsoring financial literacy education for the schools in your area.

8 Reasons You’ll Love Partnering with Stukent

1. You’ll grow your customer base.

Sponsoring a Stukent product is an easy way to get your name in front of future customers. Grow your business through brand awareness by impacting the lives of many young people in your community.

2. Mimic Personal Finance helps your future customers become financially literate.

When our communities are financially literate, everyone benefits: families have increased financial stability, and young adults get started on the right track with money management and debt.

3. Sponsorship shows you care about your customers and community.

Giving back is a critical part of building relationships in your community. What better way to show people you care than to invest in their families? When you partner with Stukent, people will know about it, and we will partner with you to create a comprehensive public relations plan.

4. Mimic Personal Finance is proven to be effective.

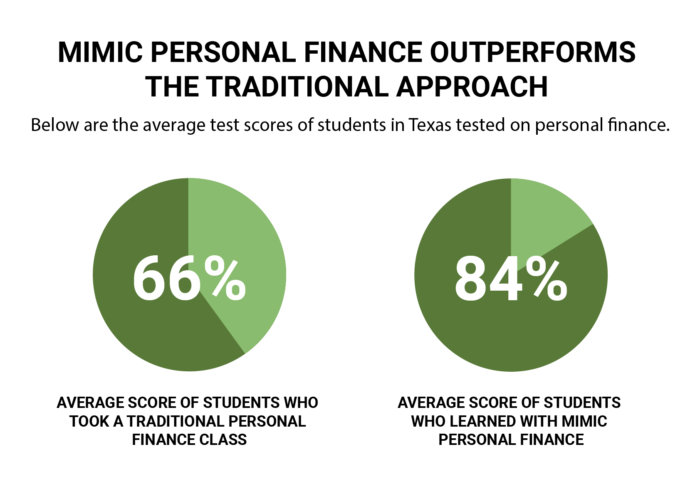

Students who used Mimic Personal Finance scored an average of 18% higher on a standardized financial literacy test when compared to students who were taught using a traditional approach. 18 PERCENT—that’s roughly the equivalent of two letter grades!

5. Stukent hosts training on your behalf in each sponsorship area.

What good is sponsoring a program teachers don’t ultimately use? Stukent makes sure teachers not only know about the program, but know how to use it and integrate it seamlessly into their classroom.

6. Teachers, parents, and students ALL love this program.

This program has garnered praise around the United States for how it engages students, makes teaching fun, and arms young adults with critical skills they need to succeed. Check out some of their testimonials here.

7. Stukent handles all the setup and school coordination.

You get all the goodwill and social credibility for sponsoring the program without any of the hassle of fielding questions, handling setup, or managing the day-to-day operations. What’s more, our customer support team is known for being blazing fast and all-around amazing.

8. You’ll actually like working with us.

We believe in the power of relationships in education and in business, and we want to create a long lasting partnership together. We work hard and we have fun doing it.

How It Works

You identify your customer base.

No one knows your customers like you. You identify the area or region you most want to impact and connect with.

Stukent identifies the schools and communities who can benefit from Mimic Personal Finance.

Mimic Personal Finance is a game-changer when it comes to financial literacy. It gives teachers world-class tools to engage their students and improve the financial health of an entire generation. Our business development team identifies every school in your customer area and personally reaches out to each one about your sponsorship.

Stukent tells EVERYONE how you’re giving back.

When you partner with Stukent to invest in your customers, we make sure people know about it. We create a complete PR package that’s unique to your company and the customers you care about. From press releases and community events to social media marketing and co-branding, we have a wide variety of tools to ensure your contributions are recognized and appreciated.

Mimic Personal Finance: A Revolutionary Approach to Personal Finance

Mimic Personal Finance uses decision-theory learning to teach students the basic principles of financial literacy in a simple and powerful way.

Mimic Personal Finance is the ONLY simulation that lets students:

- Practice decision-based learning

- Make real-world financial choices

- Go beyond theory to application

- Experience real, in-class consequences

How Mimic Personal Finance Works

Banking

Students start with budgets to track and basic bills to pay. Academic performance in class determines if they earn raises to their salaries or lose income.

Assets & Liabilities

Students develop credit scores based on in-class behavior and simulation decisions. The scores allow them to take on liabilities and purchase assets like cars and housing.

Income Growth

Students can explore other sources of income such as starting a business in class, taking a second job, or investing in the stock market.

Life Happens

Just like the real world is full of the unknown, students experience unexpected events that influence their finances within the class.

Buying Grades

By applying budgeting skills, students regularly purchase their Mimic Personal Finance score that can then be factored in as part of their total grade in class.

Teachers LOVE Mimic Personal Finance

And So Do Businesses

Does Mimic Personal Finance Really Work?

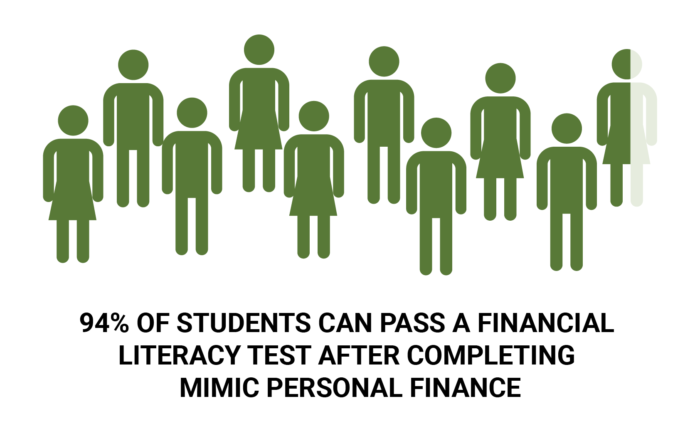

Sure, it sounds awesome, but does this new approach to teaching financial literacy really help the students? The answer is a resounding “Yes!”