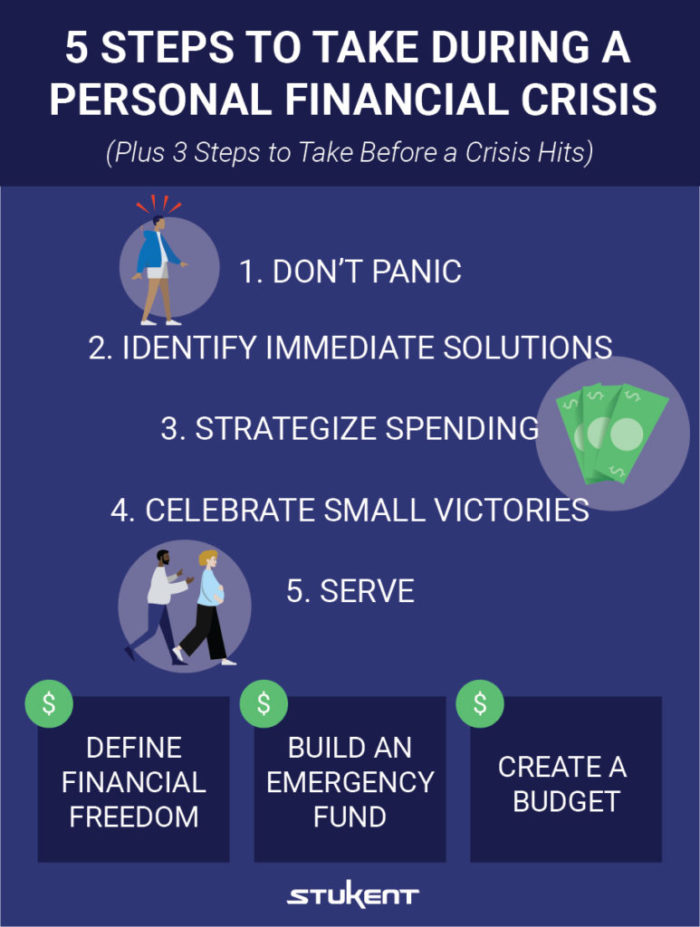

(Plus 3 Steps to Take Before a Crisis Hits)

It’s not news that these are uncertain times.

In response to the recent pandemic, many people are forced to stay home from work temporarily, and some have lost their jobs altogether. People are spending less money due to unemployment and social distancing, and it’s negatively impacting the economy. Not to mention, people are scared.

These problems can’t be solved overnight, but if you’ve found yourself in the middle of a personal financial crisis, there are a few steps you can take to improve your situation:

1. DON’T PANIC

Panicking will only make the problem worse, and it leads to the making of irrational and fear-based decisions. When a crisis hits, find time every day to do something that calms you, like mindlessly doodling, playing an instrument, or meditating.

These activities won’t magically solve your problems, but they’ll allow you to brainstorm solutions with a clearer mind.

2. IDENTIFY IMMEDIATE SOLUTIONS

Make a list of all the things you spend money on. Then, label them as a need, want, or luxury. Be honest with yourself as you evaluate these categories — you can even enlist the help of a trusted mentor. Keep the needs, find cheaper alternatives for the wants, and eliminate the luxuries.

How long has it been since you shopped around for services? It’s time to examine the costs associated with phone plans, subscriptions, electricity, etc. Explore alternative providers and plans to see if you can find better deals.

There is money hiding from you somewhere. Go find it! You can sell unused items around the house, take on a part-time job, or work overtime if the opportunity arises.

3. STRATEGIZE SPENDING

Create goals that set you up for success. Don’t just say, “I want to save more money on groceries this month.” That is too vague. Make specific strategies for success. Here are some examples:

- Plan your meals in advance for at least a week. When you go to the store, stick to your shopping list and have a specific plan for each item you buy.

- Identify foods that provide a variety of meal options. For example, purchase ground beef, lettuce, tomatoes, and cheese to make both tacos and hamburgers. You’ll save money and waste less food.

- Ask a coworker or classmate to carpool. Driving your car half as much will reduce your gas expenses by 50 percent. You will also save on maintenance costs as your vehicle will sustain less wear and tear.

4. CELEBRATE SMALL VICTORIES

One of the biggest trials during a crisis is facing the overwhelming feeling that you won’t get through it and that life won’t ever be the same. It’s okay to worry, but focusing on hardships for too long isn’t productive. Find ways to celebrate little wins.

Did you save $5 by using coupons at the grocery store? Way to go! Did you save $10 this month by riding your bike more? Great work!

Small victories add up over time and ultimately help you reach your goals.

5. SERVE

Find a way to make someone else’s life a little better. While this may seem counterproductive, focusing on others leaves you with less time to worry about your own situation. You will have a more positive attitude, and you will be more successful in solving your problems.

3 STEPS TO TAKE BEFORE A CRISIS

The stress of finding yourself in the middle of a financial crisis can be overwhelming, but if you take preparatory steps before a crisis hits, you can lessen the blow.

Here’s what you can do to prepare:

DEFINE FINANCIAL FREEDOM

Financial freedom does not refer to how much income you have. It refers to your ability to do whatever you want with the income you have. When you are in debt, you do not have the freedom to do whatever you want with your resources.

Decide what a financially free future looks like to you. Do you travel a lot? Do you have a home big enough for a large family? Do you retire early? This will look different for each individual, but having this vision will motivate you to stick to your goals.

BUILD AN EMERGENCY FUND

One common mistake people often make when seeking financial freedom is paying off their debts without building any savings. Imagine you’re about to pay off your credit card, and your car breaks down. If you don’t have any savings, you’ll have to charge your credit card again. Building an emergency fund first gives you a safety net and allows you to avoid going into further debt.

The size of your emergency fund is up to you, but it should be at least $1,000 while you are paying off debts. Then, you’ll want to save enough money to cover three to six months of living expenses.

CREATE A BUDGET

Budgeting is not about monitoring your spending — it’s about behavior modification. There are many strategies for budgeting such as using the envelope method, a mobile app, etc. Figure out what works best for you and your goals, and go all in.