High school science teacher and father of three Brian Bean worked hard to earn a good credit score. His limited teacher’s salary didn’t give him a lot of extra funds, but he wanted to be responsible with the money he did have.

Brian got involved with a financial coaching firm who said they could leverage Brian’s good credit to make financial and real estate investments that would earn him increased dividends in the future. “I was pretty naive at the time,” Brian says. “I didn’t know much about personal finance or fancy investing and the individuals seemed trustworthy, so I believed in them.”

As time progressed, Brian started to notice some red flags. He started looking closer into his financial situation and realized the company had leveraged his personal credit for $1.2 million of debt. “It was basically an elaborate Ponzi scheme,” Brian says. “And I was a school teacher qualifying for food stamps. I ended up having to declare bankruptcy and start life over at 30.”

“It was basically an elaborate Ponzi scheme. And I was a school teacher qualifying for food stamps. I ended up having to declare bankruptcy and start life over at 30.”

—Brian Bean

Thankfully Brian’s story doesn’t end with declaring bankruptcy. He actually went back to school and got a degree in banking and finance. He also got a master’s degree in teaching methodology and created the Real-World Classroom Teaching Model.

“I got really frustrated with the education system in particular,” Brian recalls. “I didn’t understand how someone could go and get a bachelor’s degree in science and still be so ignorant to something that should have been practical knowledge to many people. So I started looking really, really closely at how we as an industry approached the topic of personal finance, and I felt like we were deficient and that there was room for improvement.”

Brian spent ten years developing the Real-World Classroom Teaching Model, specifically with the goal of giving students the chance to actually experience personal finance, not just learn about it. He then created a one-of-a-kind personal finance simulation, Mimic Personal Finance, that comes complete with curriculum, lesson plans, presentations, class activities, and more that teachers can use in their schools.

3 Pillars of the Real-World Classroom Teaching Model

1. Realify not Gamify

The Real-World Classroom Teaching Model is focused on allowing students to experience real consequences for their choices. Mimic Personal Finance gives students real-world consequences for their financial choices. “It’s NOT just a game,” Brian says. If students perform poorly in the simulation it affects both their grade and their classroom privileges. Likewise, how they perform in class also affects their performance in the simulation.

2. Focus on the Decision-making Process

Brian wanted to create an environment where students’ choices dictate the learning experience. Lessons are continually reinforced as each decision a student makes impacts their experience for the remainder of the course. Rather than simply memorizing terms, students are putting concepts into action, evaluating their results, and adjusting their behavior accordingly. This allows them to not only understand the why behind the concepts, but also master the how of applying those concepts into their lives.

3. No One-size-fits-all Solution: Create a Differentiated Learning Experience for Students

Traditional teaching forces students into a mindset that there is only one right answer. “This is not the way the real world works,” Brian says. “Financial goals are different for each person, so is the definition of financial success. By letting choices dictate outcomes, a differentiated learning experience is naturally created. Students learn more about themselves and their personal approach to financial matters.”

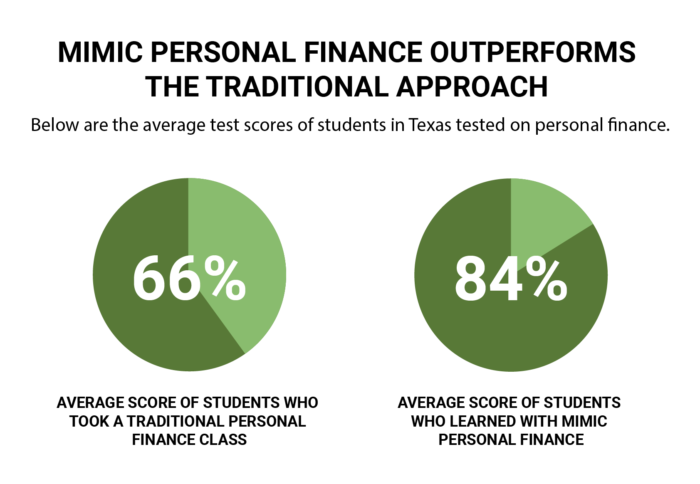

Does the Real-World Classroom Teaching Model Work?

Sure, it sounds awesome, but does this new approach to teaching and financial literacy really help the students? The answer is a resounding “Yes!”

Brian tested 153 of his own students using the Precision Exams Standardized Test 4501: General Financial Literacy. The average score for other personal finance students in Brian’s home state of Texas was 66%, not exactly a glowing recommendation for the traditional approach. However, students who learned personal finance using the Real-World Classroom Teaching Model had an average score of 84%.

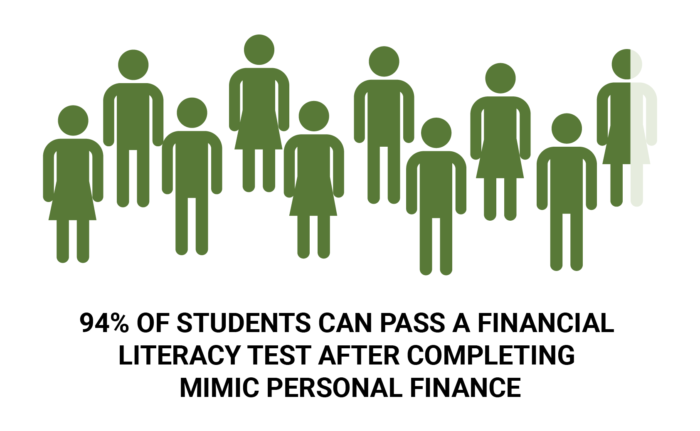

What’s more, 94% of students who learned with the Real-World Classroom Teaching Model passed the test!

Free Resource for the 2019-2020 School Year

Stukent is offering 2,000 high schools the opportunity to use Mimic Personal Finance for FREE during the 2019-2020 school year. To apply for a grant, go to www.stukent.com/mimic-personal-finance.